Hi investors, today @tradealert and @deanliu join forces to introduce COBINHOOD, an exciting new ICO platform and exchange.

We’ll start by presenting the platform’s most interesting features (I), Dan (@tradealert) will share his personal trading experience on the exchange since Dean (@deanliu) has already shared his experience right after the platform lauched (II) and we’ll conclude by discussing how you can invest in Cobinhood through their native COB token (III).

I - The platform.

COBINHOOD is new exciting hybrid crypto platform which allows its users to trade and participate in ICOs all in the same interface. The young team behind the project is based in Taiwan and the CEO Popo Chen has extensive experience as an entrepreneur. Interestingly, the project is advised by Tony Scott who is the former CIO at VMWare, Microsoft and the Walt Disney Company.

The project maintain a Github page, a Discord channel and a subreddit where most of the community is active.

Finally, the platform possess its own native token: COB which we will talk about later in more detail.

Cobinhood has three very distinctive features that sets it apart from its competition:

- The first and the most ubiquitous is the zero-fees trading policy which is unique to the project and a potential game changer in the industry. For comparison with other exchanges you can refer to the table below, notice how the average taker fee stands around 0.2% in most other exchanges (although exchanges like Binance allow for a discount when using their native token to pay for fees). It should also be noted that Cobinhood also allows COB token holders to receive a 50% discount on margin loans when these are settled in COBs.

- Second, Cobinhood provides underwriting services for ICOs which, combined with the exchange feature, will allow any project that uses its platform to access to instant liquidity making it very appealing for investors. Additionally, all COB token holders are entitled to discounted ICO token offers proportional to the number of COB tokens they hold. Here’s an example of how this worked in their first ICO (CyberMiles/CMT):

- Third, Cobinhood plans to enable fiat transfers in the future which is a feature that most centralized exchanges lack of and could help capture some of Bitfinex’ US users as well as ensure the financial health of the platform.

So, the fundamentals look all fine and dandy but what about the experience.

II- Dan’s experience.

I’ve been trading on Cobinhood using the desktop web interface for about two weeks now and the experience has been very positive and smooth so far. Here’s some of the things you should now before jumping in though.

Fees an Feel.

- The zero trading fees is a breeze of fresh air and it was really nice to be able to trade between currencies without constantly feeling ripped off. Beside, Cobinhood has some of the cheapest Bitcoin withdrawal fees I’ve seen in a centralized exchanges (0.005 at the time of writing) which really surprised me;

- The interface looks sleek and is easy on the eyes for someone that mostly trades at night like myself. The different menus are easy to navigate and they have a very responsive customer support (at least it was fast in my case).

Withdrawals.

- It’s important to note that withdrawals cannot be executed unless you are verified at level 1 or above (you can deposit without being verified though) so I recommend you obtain a level 1 verification before you start trading on Cobinhood so to avoid any drama. It took me about a day to be verified at level 1, it was very simple and did not require me to submit any ID documents or personal addresses;

- The second thing to note is that withdrawals aren’t automated yet so there can be quite a bit of delay there. The reason for that is because they are still being manually verified for security reasons but the team has announced that automatic withdrawals will be enabled in late January.

Coins and liquidity.

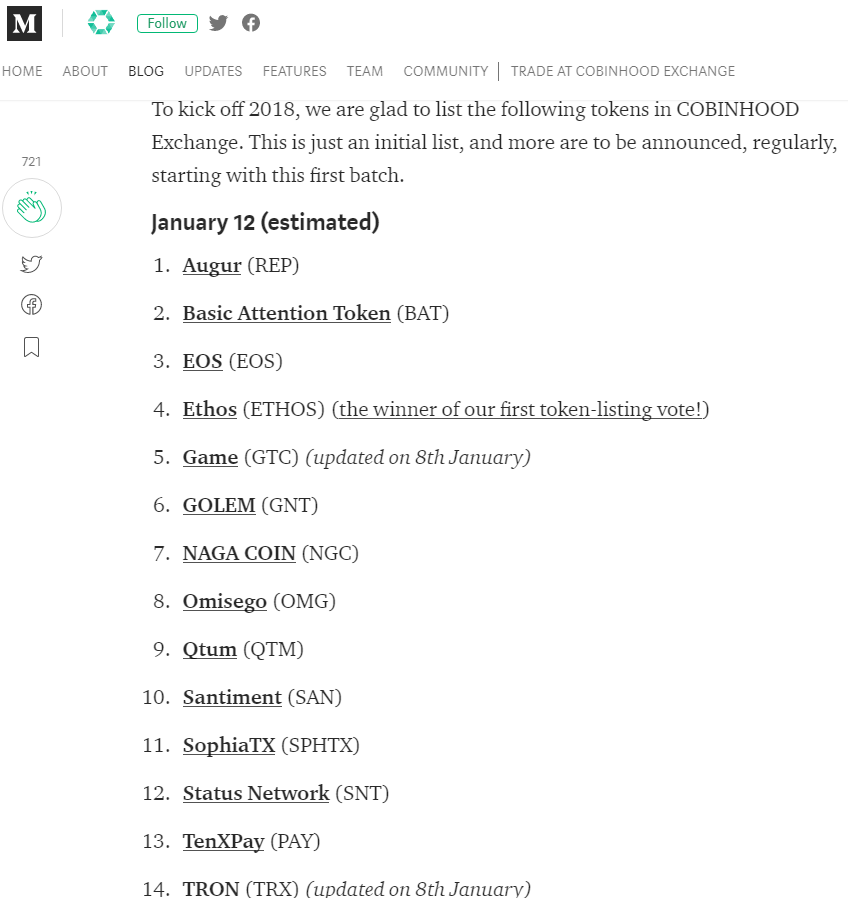

- Right now the exchange feels a bit like a ghost town, order books are very thin and only 4 tokens are listed (BTC, ETH, COB and CMT), however the team has said they plan on listing new tokens very soon (see below and here for more):

- Finally, I was able to get CyberMiles (CMT) tokens almost for free by just holding COB through the CMT ICO which took place on the platform just a few weeks ago. The gain wasn’t extraordinary but it was nice to be airdropped some tokens and this system has some interesting potential although the rewards would need to be more consequent to really constitute an incentive to hold more COBs.

In conclusion, the experience was very enjoyable and I am looking forward for the exchange to list more coins and pick up more liquidity so to allow me to trade there with bigger sizes. I believe that the zero-fees policy is going to attract a lot of traders and will be a game changer for the industry.

So, if you believe like we do that Cobinhood’s future is bright under the crypto sun, why not invest in it?

III - Investing in Cobinhood.

- The main investment thesis behind acquiring COB tokens is that the demand for COB tokens is probably going to increase rapidly as the platform gains in popularity both as an exchange and as an ICO hub, in simpler term, COB could become the next Binance coin (BNB);

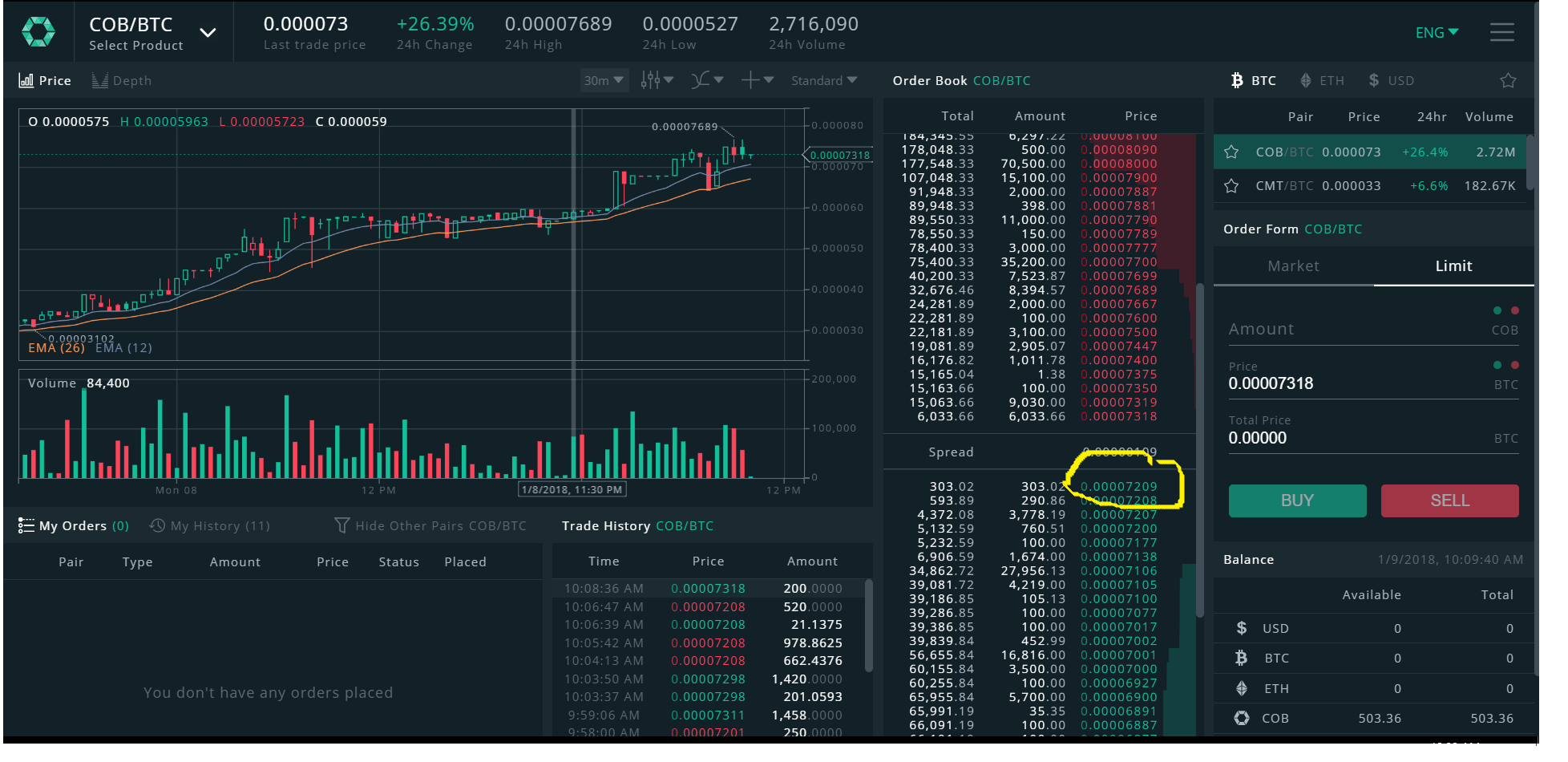

- Investing in the platform can be done by purchasing COB tokens. Right now, COBs trade on three markets: EtherDelta, Mercatox and Cobinhood (not yet listed on CMC) but there is massive fluctuation in price between those exchanges due to COB tokens deposit not being allowed on Mercatox.

So your cheapest option to buy COB is Cobinhood itself:

However, make sure to go easy on position size since, as we mentioned before, the COB order book is quite thin there.

So that’s it for today folks and we hope you learn something new, don’t forget to re-steem, upvote and follow @tradealert and @deanliu if you like our featured content.

Cheers,

Dan & Dean.

disclaimer - Cobinhood images from their respective official sources.

This page is synchronized from the post: ‘COBINHOOD - A Rising Zero-Fee Crypto Exchange and ICO Platform’