Hi investors, Dean (@deanliu) and Dan (@tradealert) are back and today we’re showing you how to use the Kyber Network decentralized exchange on Ethereum.

I-Executive Summary.

Kyber Network is an on-chain Ethereum protocol which allows for instant, decentralized and liquid trading of Ethereum-based digital assets.

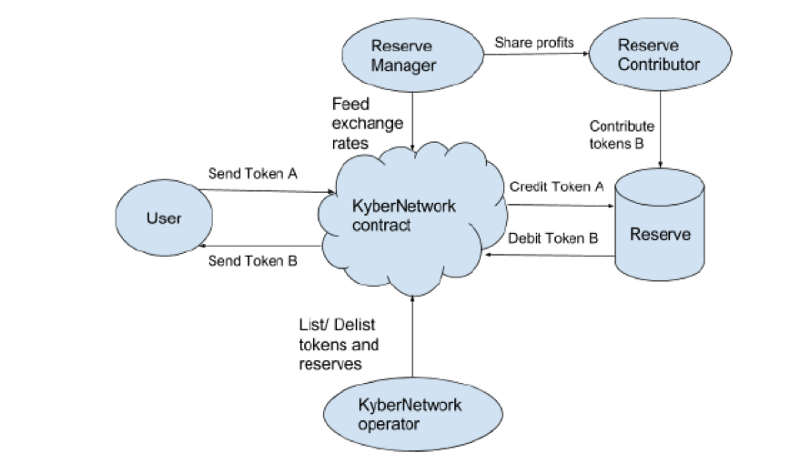

Liquidity is provided by private skate-holders called reserves who pay rent to Kyber Network in the form of Kyber tokens (KNC) for the right to operate and earn profits from trading activities. KNC tokens spent as rent are burned, thus diminishing their total supply and (in theory) increasing their value. Listing and de-listing of tokens is managed by the network operator. At first the Kyber team will act as platform operator but plans on decentralizing its governance in the future.

Here’s a brief overview of how Kyber Network works:

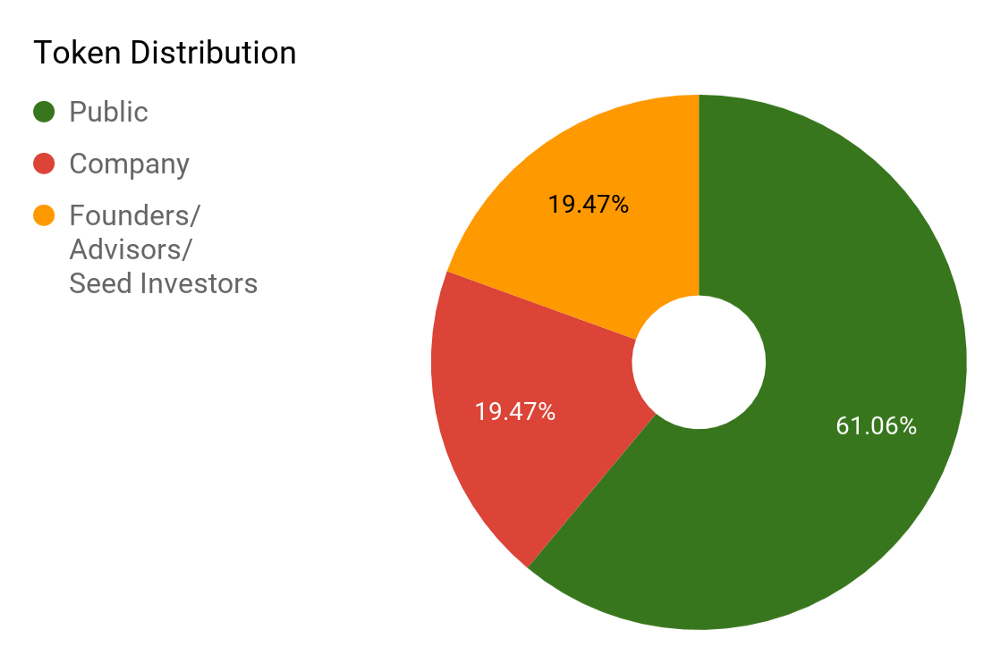

Kyber is incorporated in Singapore (a country friendly to crypto) and its development team is spread across Singapore and Australia. The project was funded through an ICO which took place in September 2017. Kyber sold 61.06% of the total supply of their native tokens (KNC) to the public and raised 200,000 ETH ($52 million USD at the time), 50% of which were allocated as first liquidity reserve to the network. The total market cap of the project stands a little above 130 million dollars at the time of writing and one unit of KYN is valued at $1 USD.

II- Use Cases:

Kyber Network’s goal is to build a complete, decentralized financial ecosystem backed by private reserve on top of the Ethereum blockchain. Stakeholders in this ecosystem will include:

Individuals, who can already use Kyber to trade tokens directly from their hardware wallet, MEW or Metamask and receive crypto payments in any tokens;

Merchants and websites will be able to use Kyber as a safe gateway payment platform allowing their customers to pays for goods and services in any tokens of their choice;

Financial dApps can plug into Kyber as market makers and leverage on-chain liquidity to re-balance their portfolio in the most transparent and liquid manner;

Reserves provide liquidity for the platform and earn trading fees;

Finally, start-ups will be able to raise funds via token sales on the soon-coming KyberGo portal which will simplify UI, UX and KYC procedures while offering insurance guarantees for investors.

Kyber’s vision of a decentralized financial platform is a powerful, if very ambitious one, but how does that translate in terms of usability.

III-User Experience.

In this section, we’re going to walk you through a trade on Kyber Network. Trading on the exchange is for the moment limited to ERC-20/ETH pairs but the project has announced that they will support cross-chain trades in the future.

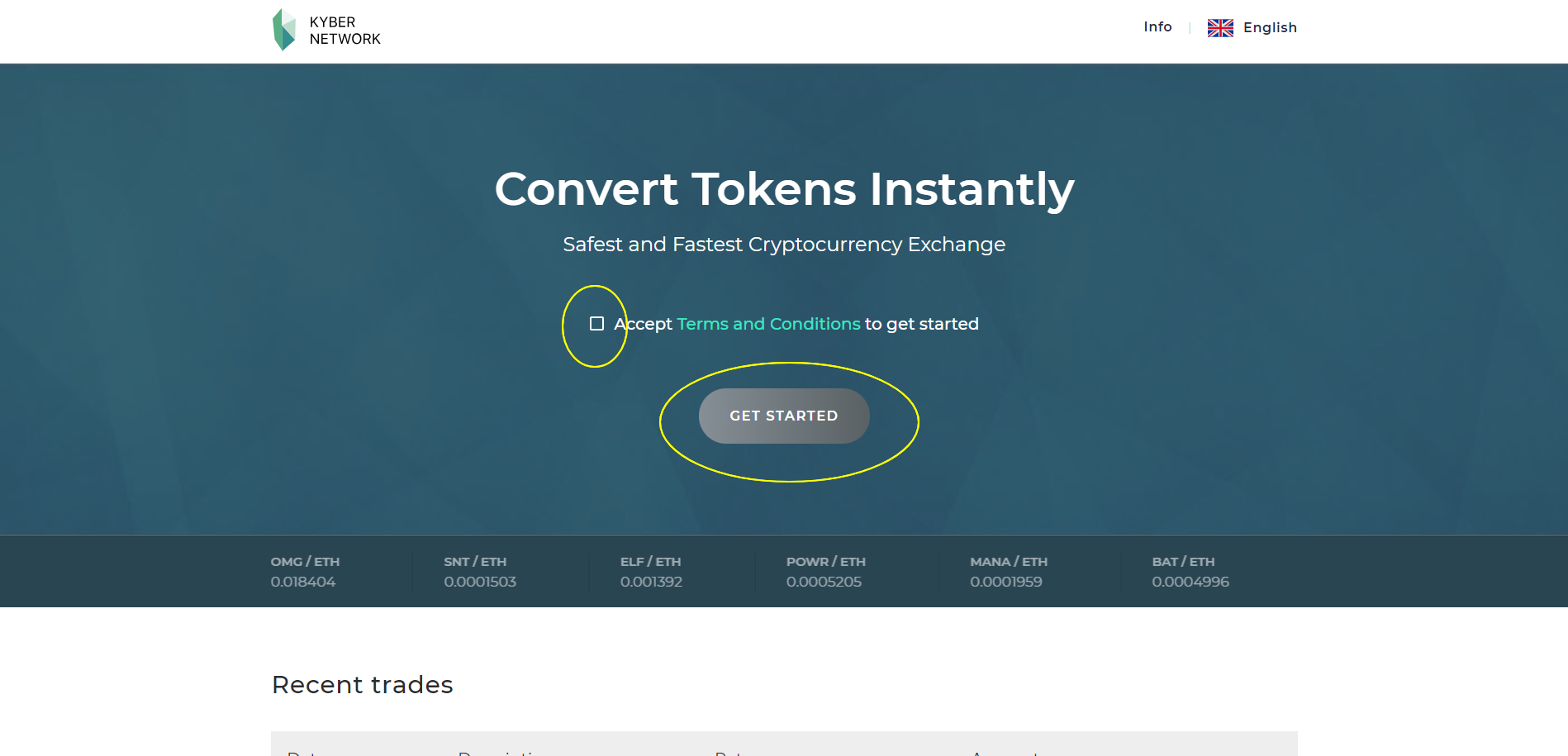

- Go to the Kyber Network website. There is no sign-up required, simply accept the Terms and Conditions and click Get Started.

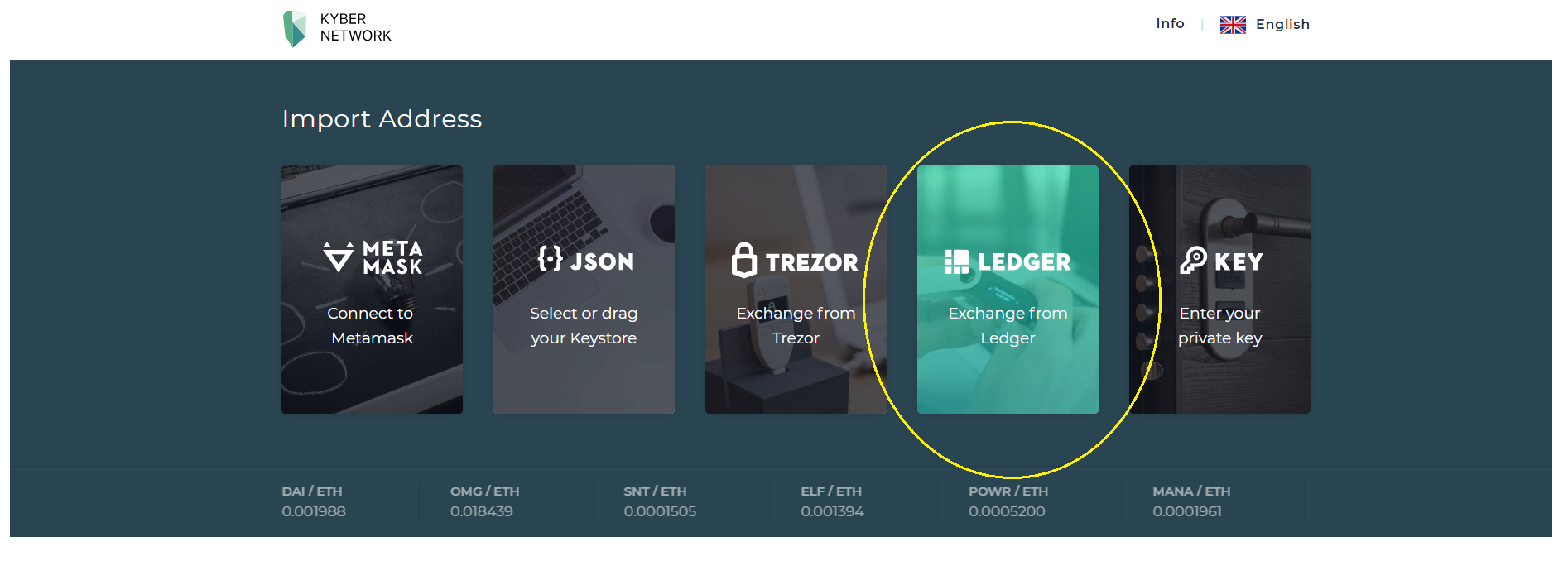

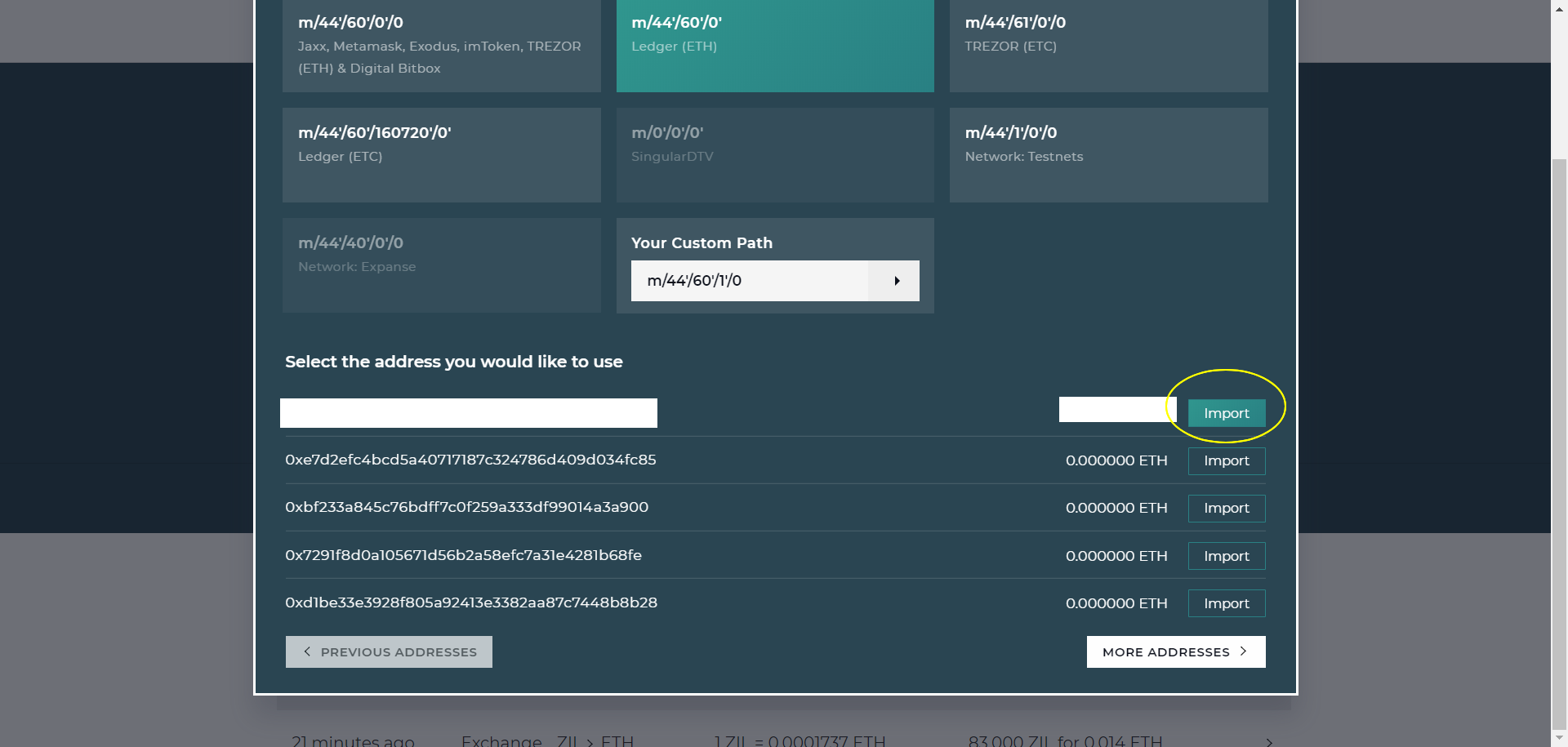

- For this guide, we’re going to use a Ledger Wallet but Kyber supports a range of popular hardware and software wallets.

- Select the address you want to transact with and click Import.

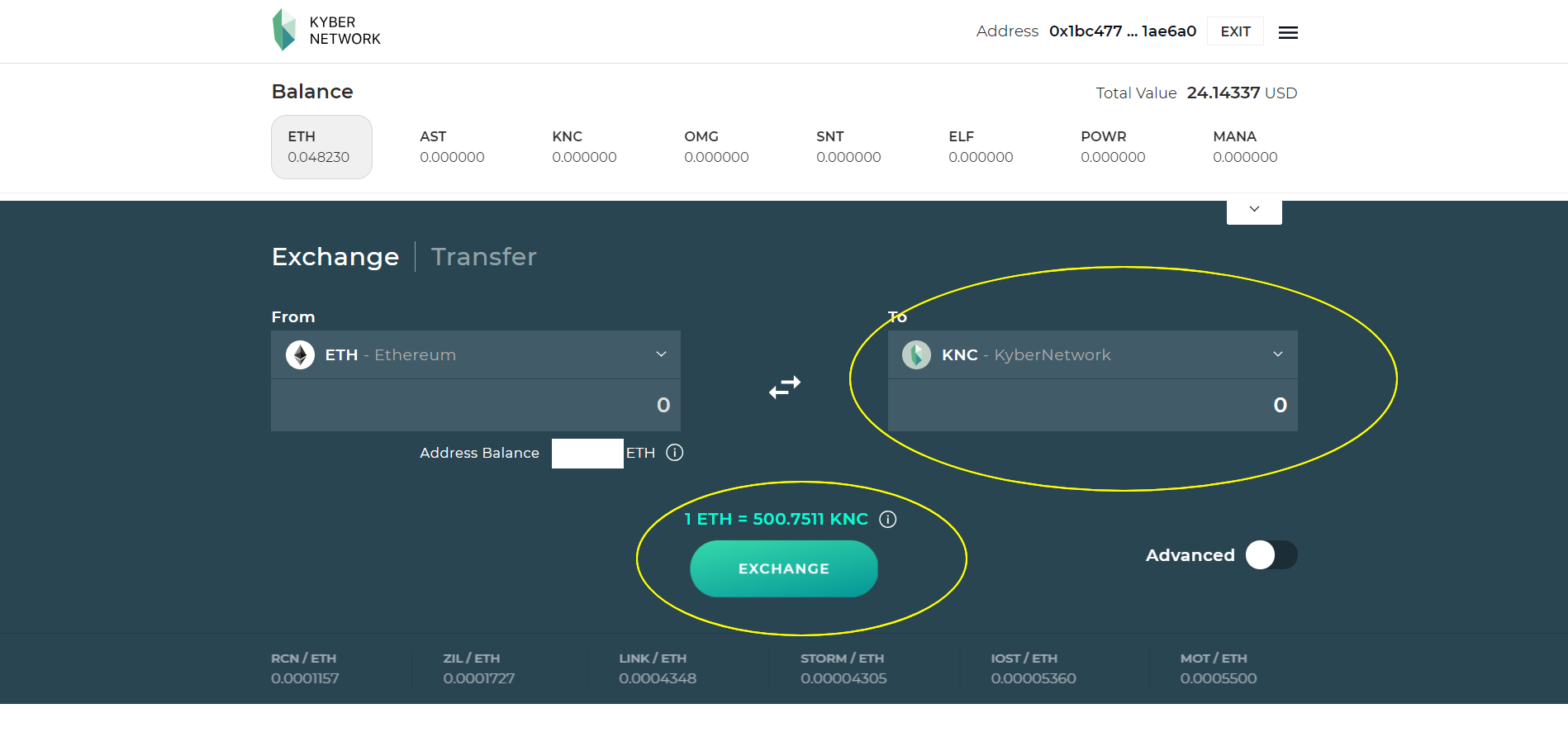

- Next, choose the tokens you want to trade, we chose to trade ETH for Kyber Crystals (KNC).

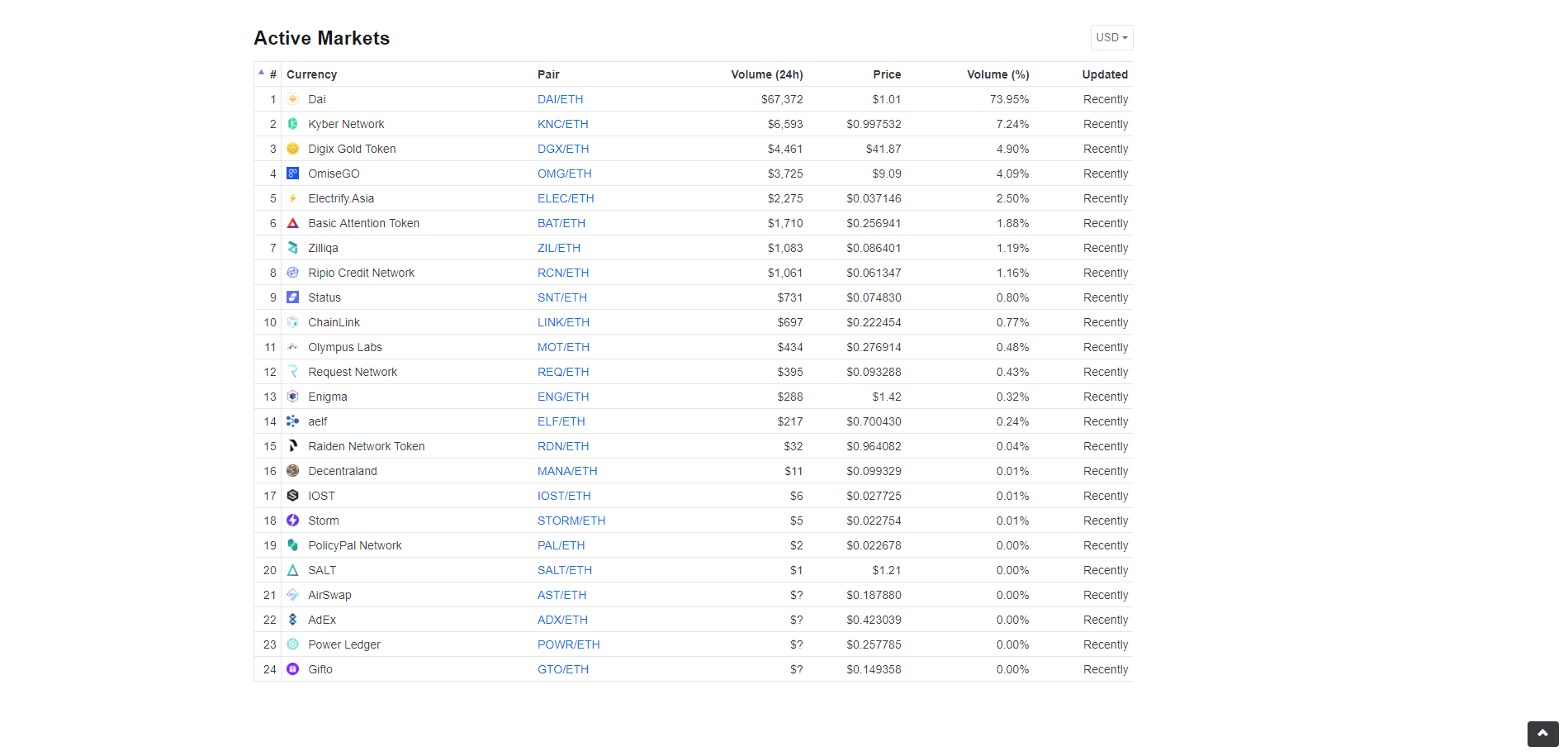

- Kyber currently support 24 ETH/ pairs including DAI which is a stable coin.

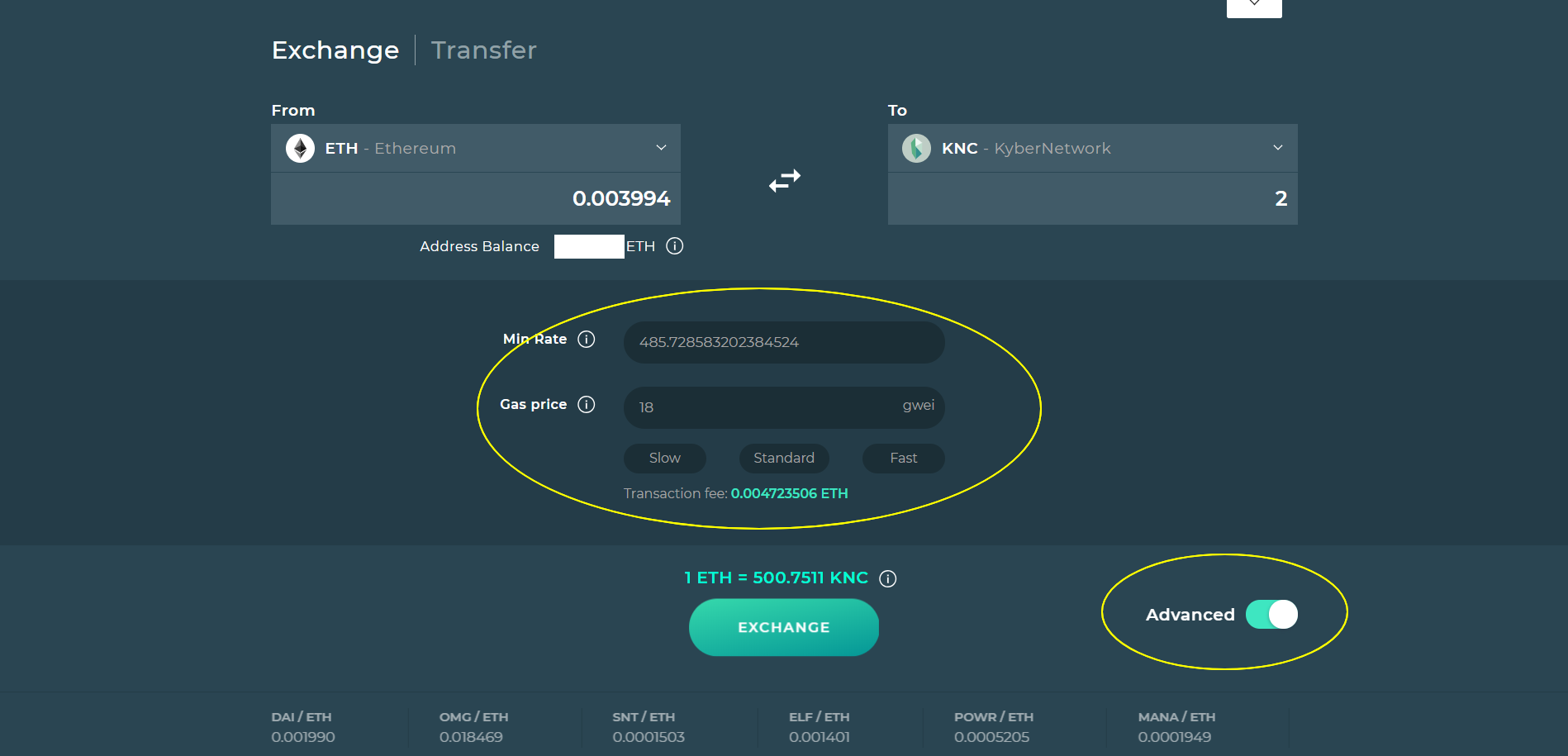

- Switching the Avanced order toggle will allow you to set limit orders and Gas price to adjust the speed of transaction, we’ll be using the default Gas price for this grand trade of 2 KNC.

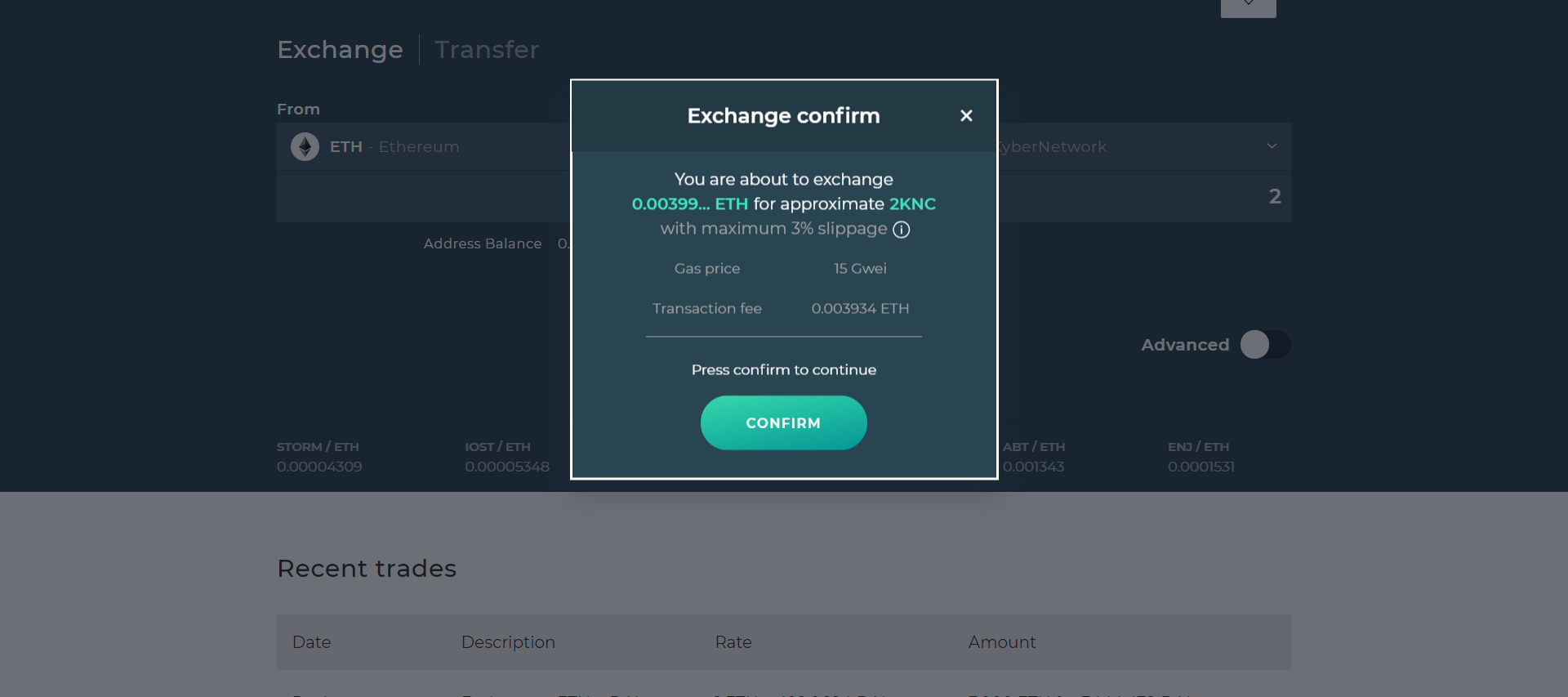

- There, a window pops up warning you that there might be slippage and asking you to confirm.

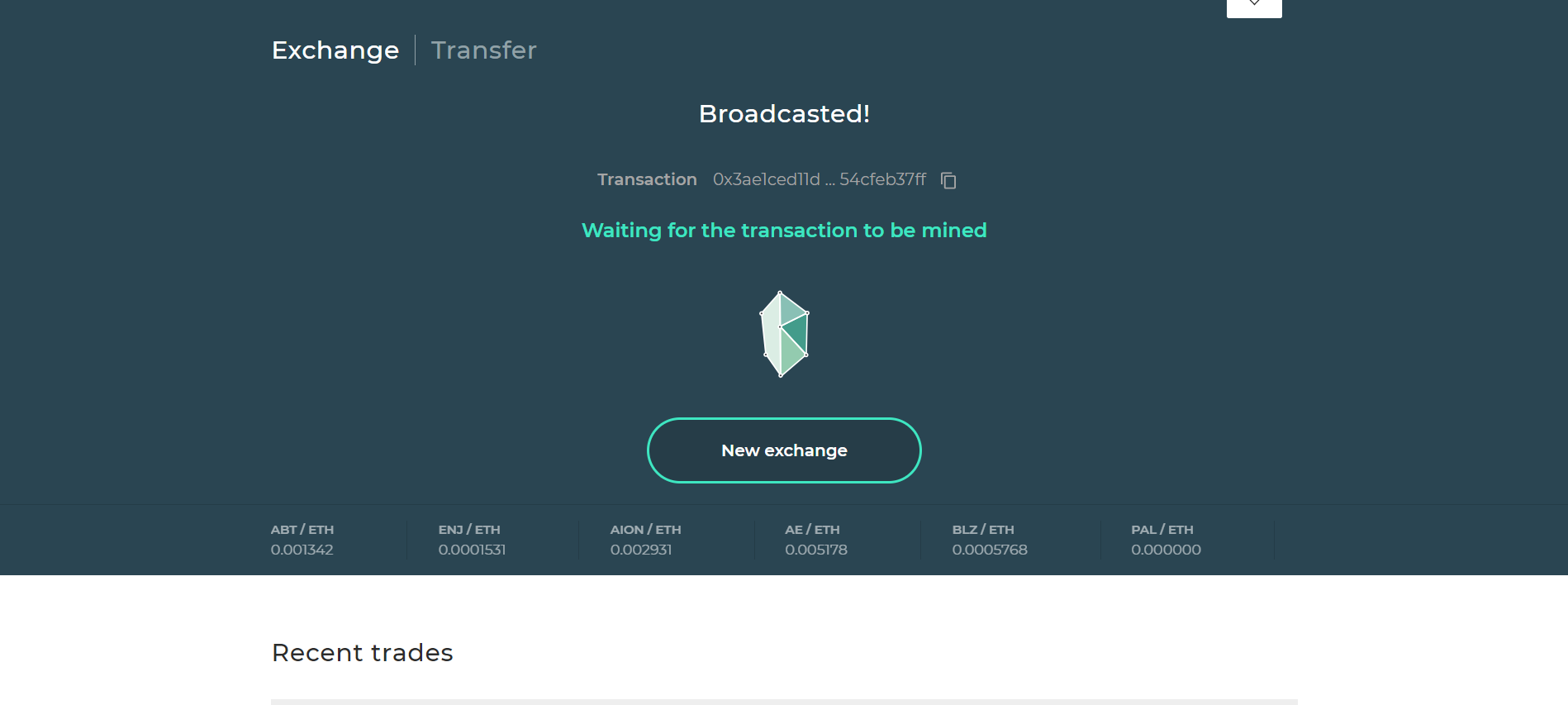

- The transaction gets broadcasted onto the Ethereum blockchain.

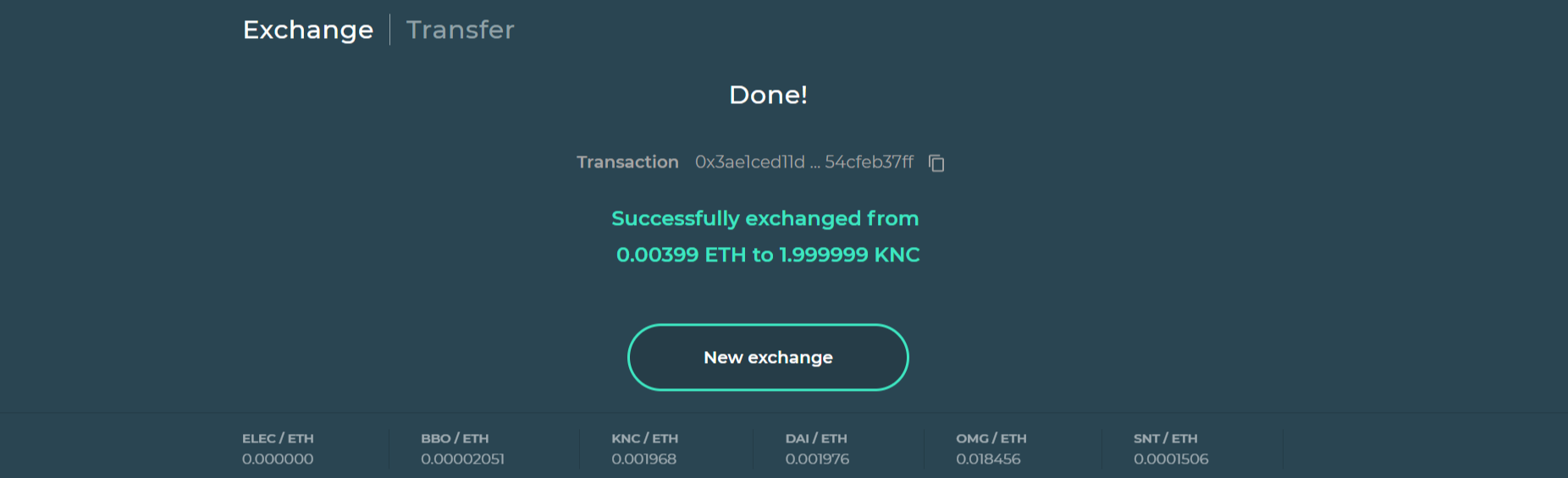

… and eventually mined, we got 1.9 KNC and only “paid” for slippage plus 18 Gwei for gas.

Conclusion.

The whole process took literally 5 minutes and didn’t require a sign-up or KYC. The tokens got transferred directly and securely on the Ledger, the user interface was clear and intuitive and will most likely seduce new users by its simplicity.

A 3% slippage for such a small order was quite steep though and probably hides a spread which compensates for the absence of fees on the exchange. However, the fact that Kyber allows you to trade very small amounts is quite remarkable in itself and suggest that the platform might offer micro-payments to merchants in the future. Also missing is a charting tool for more advanced users and the ability to place more complex orders than what basically amounts to a market order.

Overall the experience was definitely fast and enjoyable, we hope that Kyber can list more tokens in the future but from the retail user perspective this is definitely a very user-friendly exchange which we strongly recommend you try for yourself.

Dan & Dean.

_If you liked this article, make sure to go check our review of [the Aragon project](https://steemit.com/dao/@deanliu/aragon-create-your-own-decentralized-organization-on-ethereum) and Dan’s [guide on how to use Radar Relay](https://steemit.com/cryptocurrency/@tradealert/trading-on-a-0x-exchange-radar-relay), a decentralized exchange based on the 0x protocol._

_ Also, consider supporting Dan’s blog by upvoting, re-steeming and following yours truly and if you’d like more content like this or if you’re simply interested in learning more about cryptocurrencies, come join our [awesome community on Discord](https://discord.gg/4VGVHrs).

Also, consider supporting Dan’s blog by upvoting, re-steeming and following yours truly and if you’d like more content like this or if you’re simply interested in learning more about cryptocurrencies, come join our [awesome community on Discord](https://discord.gg/4VGVHrs).  _

_

BTC: 1ERWNF6Pzf4XNHkTf6Hz6UkiFhfMWifrjK

BTC: 1ERWNF6Pzf4XNHkTf6Hz6UkiFhfMWifrjK EOS: 0x942a1F730f6ED432e663869d61097E73D48037d2

EOS: 0x942a1F730f6ED432e663869d61097E73D48037d2 ZEN: znd4A1TVbnn76YDNrRb8vxeCvu3WBvZeV1a

ZEN: znd4A1TVbnn76YDNrRb8vxeCvu3WBvZeV1a ZEC: t1LLdgocLyNv5Vid5LeKNPEoaNzQWAVF6LN

ZEC: t1LLdgocLyNv5Vid5LeKNPEoaNzQWAVF6LN![]() ETH: 0x942a1F730f6ED432e663869d61097E73D48037d2

ETH: 0x942a1F730f6ED432e663869d61097E73D48037d2

Recommended Exchange:

Recommended Exchange:

Coinbase

Radar Relay

Kyber Network Hardware Wallet:

Hardware Wallet:

LEDGER NANO S Buy Gold with Bitcoin:

Buy Gold with Bitcoin:

Vaultoro

This page is synchronized from the post: ‘Kyber Network: A Platform for Decentralized Finance.’