Hi investors, Dean (@deanliu) and FØx (@tradealert) are back and today we dive deep into the world of decentralized dark pools.

Executive Summary.

Republic Protocol is an open-source protocol for creating decentralized dark-pools built to trade large amounts of crypto-currency.

The project was co-founded in 2018 by Taiyang Zhang (currently CEO) and Loong Wang (currently CTO) and consists of 8 core developers and 2 community managers.

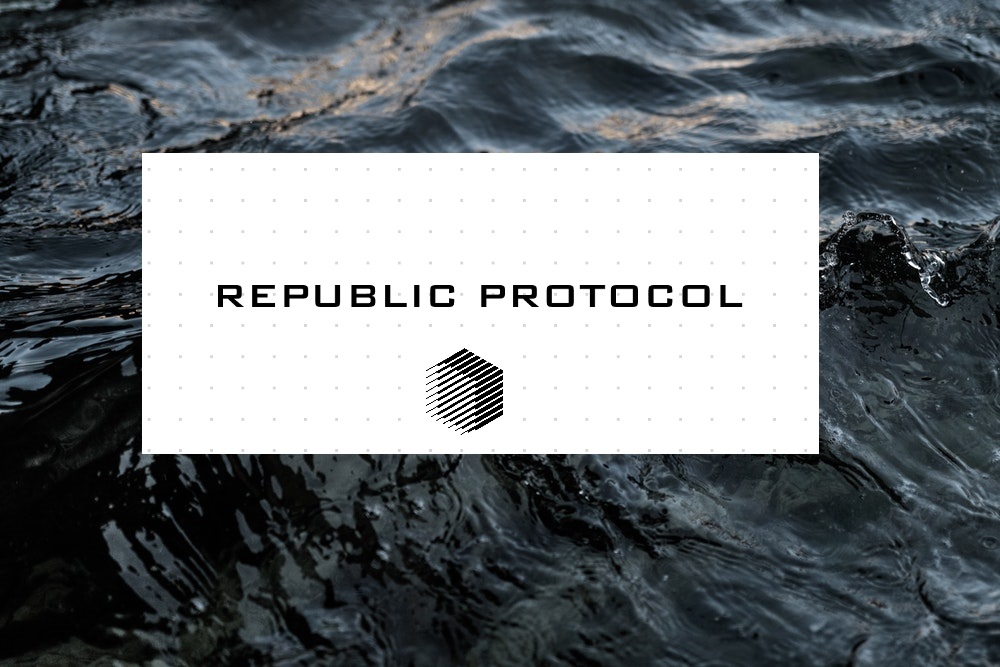

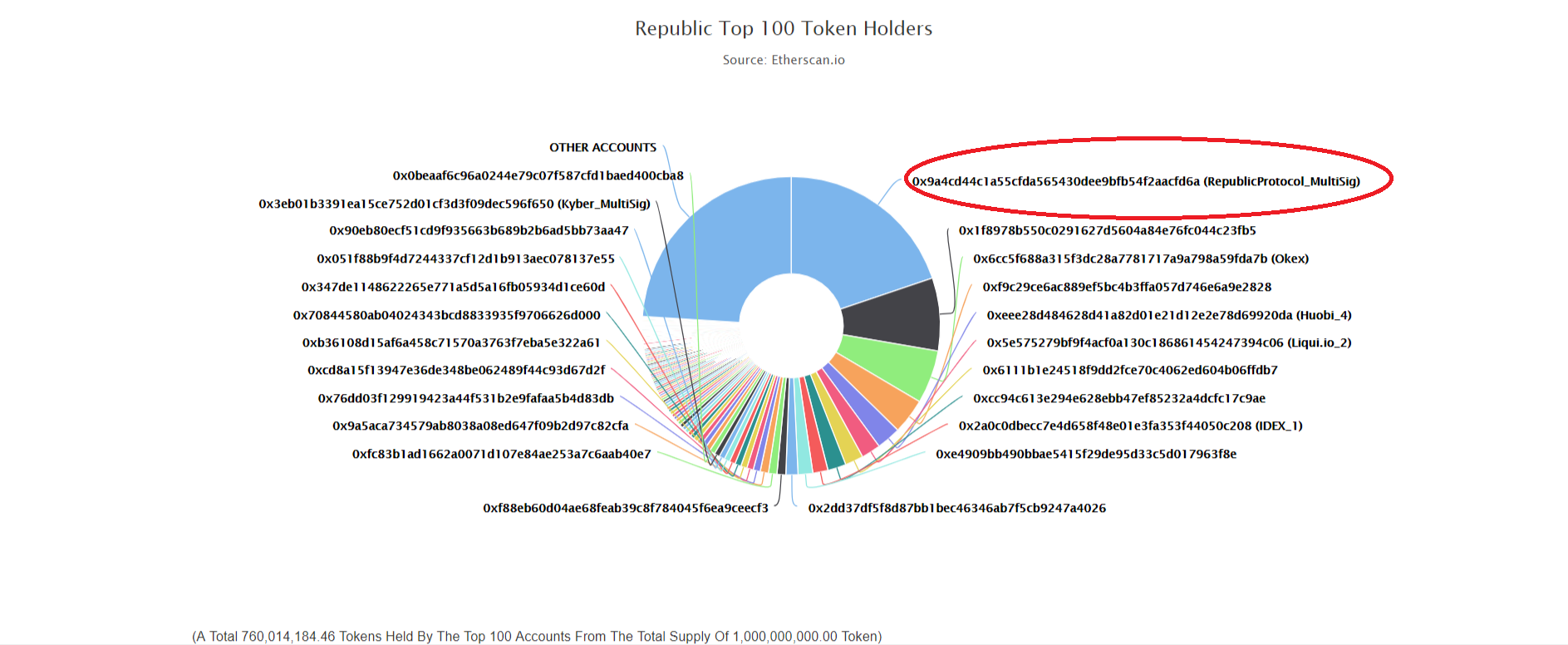

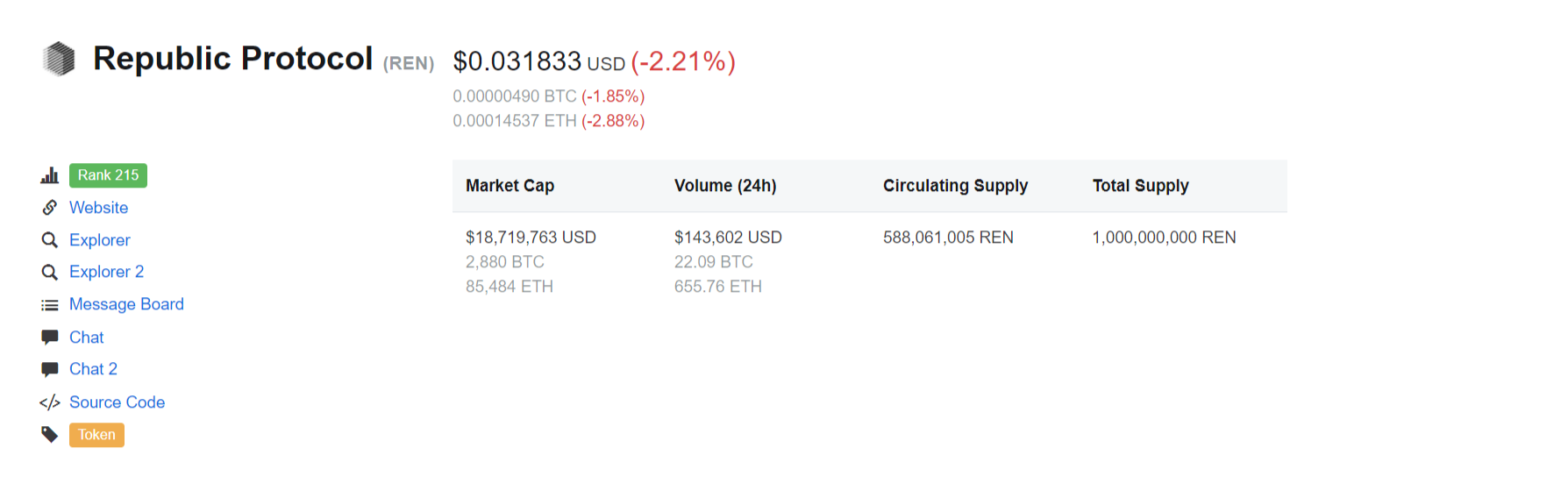

Sixty percent of a total supply of 1,000,000,000 of REN (ERC-20) tokens were put on sale for $0.5 USD/REN during a February 2018 public ICO which raised $34,400,000 USD. The project attracted a number of high-profile VC investors among them PolyChain, Huobi Capital and FBG Capital.

Like most ERC-20 tokens, REN has considerably under-performed in 2018 and the token is currently trading around $0.031 USD at x0.56 its ICO value.

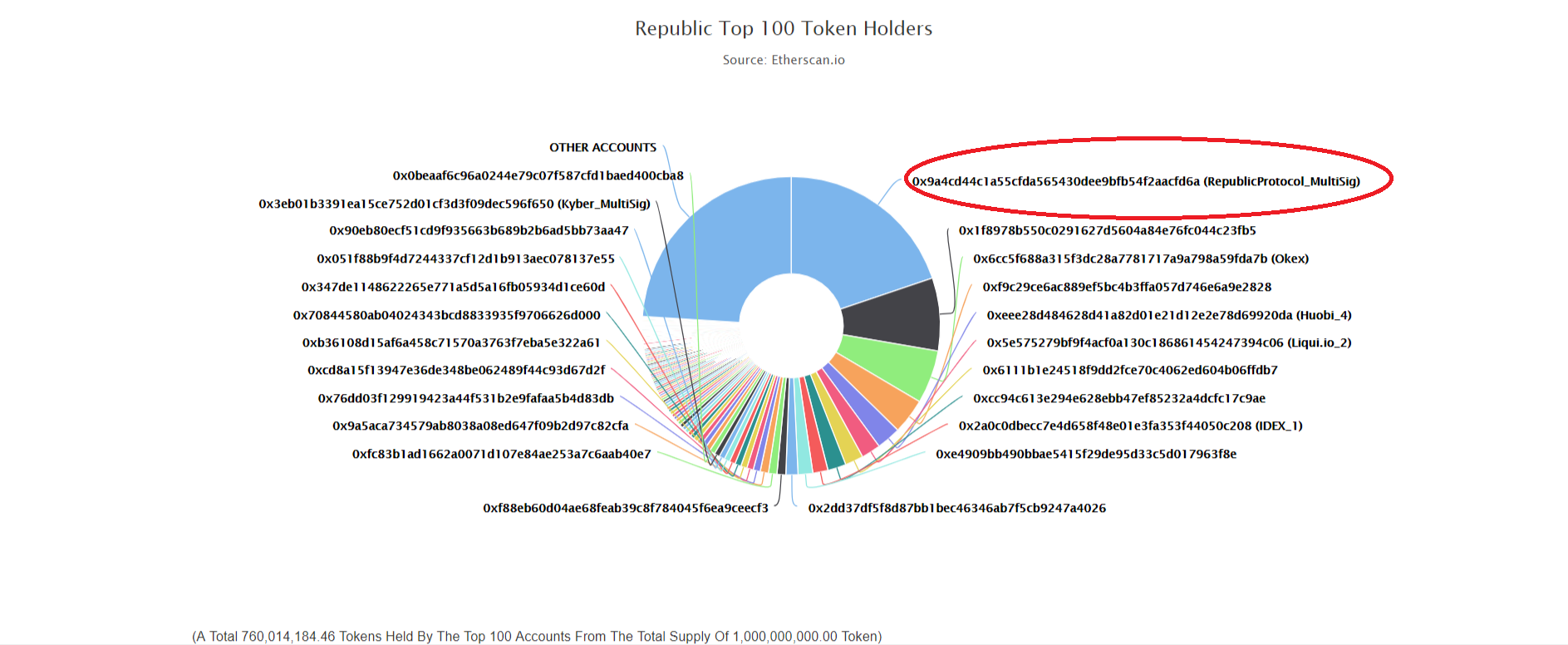

Around 20% of the supply of REN is still owned by the project according to Etherscan.

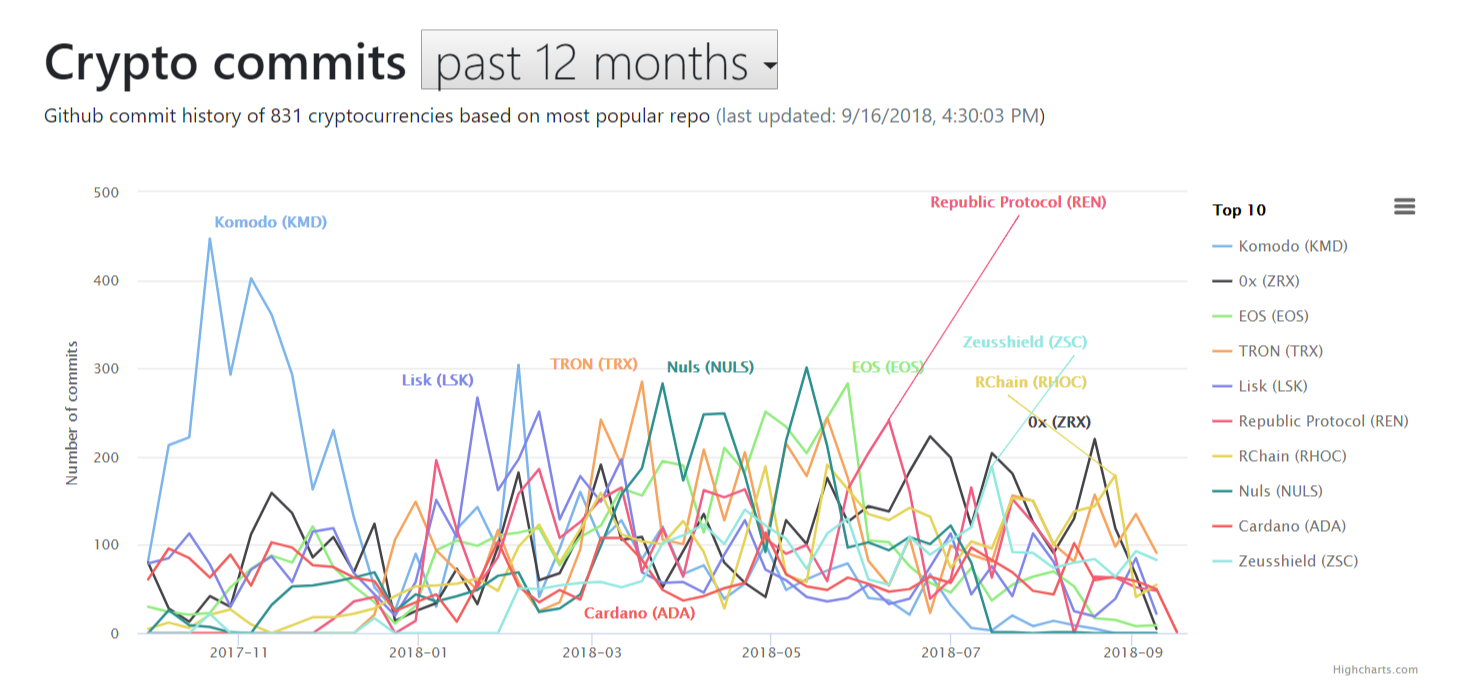

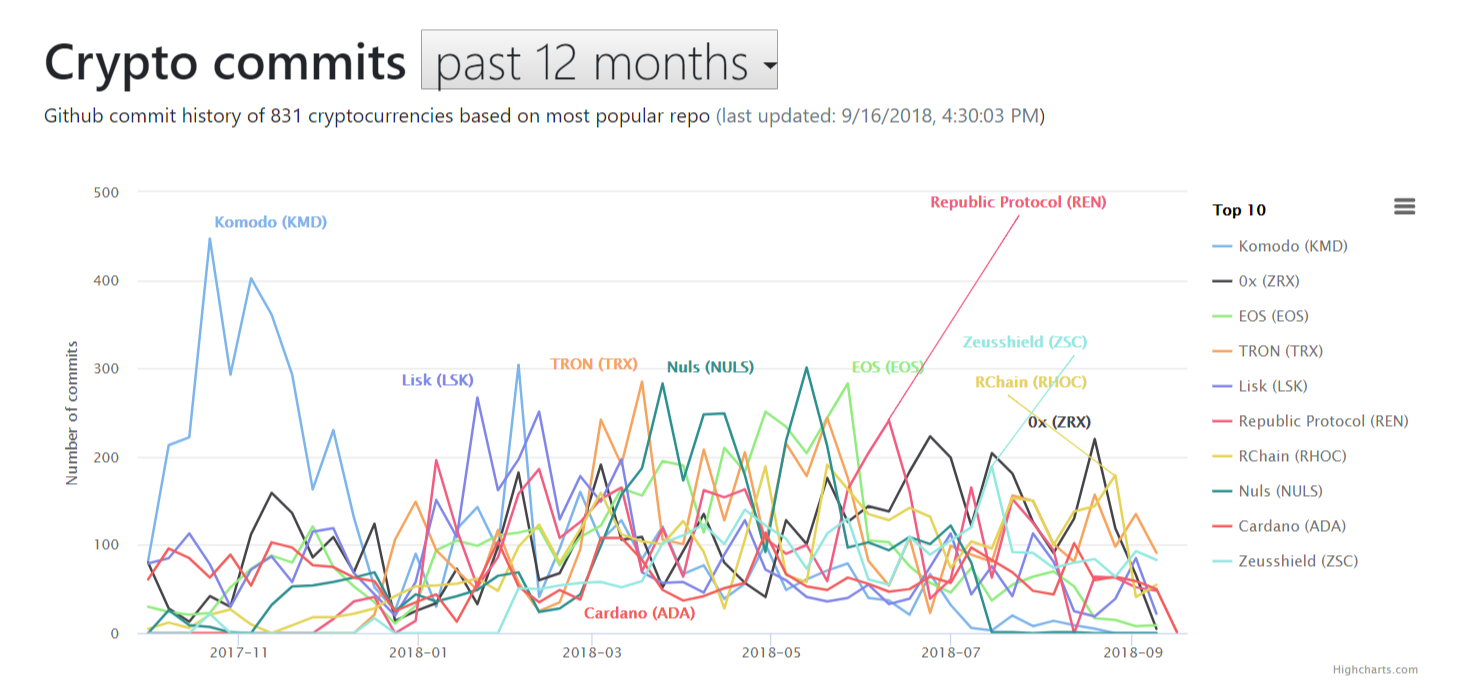

Republic’s devs have been hard at work, ranking 5th place in the top 10 most active projects on Github in the past 6 months (right behind EOS) and 6th place over the past 12 months which is impressive for such a small team.

Before diving into Republic, it helps to understand how dark pools function in traditional markets.

Dark Pools in Traditional Markets.

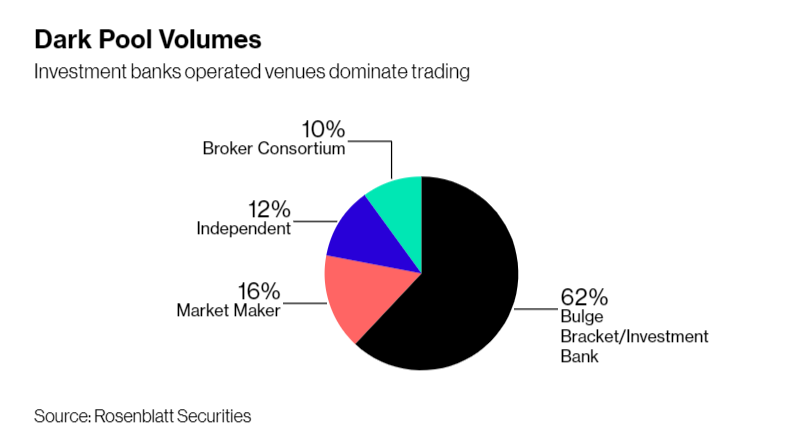

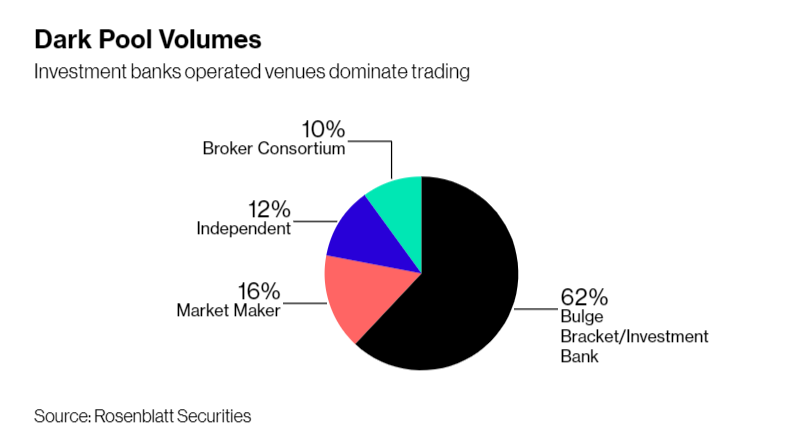

Dark pools are private exchanges run by large institutions (typically investment banks) where financial assets (like stocks) can be traded privately.

Contrary to common belief, dark-pools are not anonymous exchanges since all market participants (buyers and sellers) have to comply to KYC and disclose their trades after they are concluded.

Unlike brick and mortar banks or NASDAQ exchanges, dark pools don’t have a physical location per se nor do they have a standard structure. Trades are usually arranged on the phone or via Skype and usually involve the 2 parties to the trade and a third-party (the broker) charged with facilitating the trade and moving the assets.

Because of their privacy, dark pools are an attractive option because they allow market participants to conduct large, strategic trades without alerting the general public and/or risking being front-run by their adversaries.

As a result, it is has been estimated that 14% of all equity is traded in dark pools in the US.

Unfortunately this privacy has comes at a cost. Dark pools have become the play-ground of high-frequency trading firms and the institutions running them (the dark-pools that is) have been accused of discriminating between their clients, prompting SEC to intervene and require more transparency and fairness.

Republic Protocol Dark Pools.

Republic Protocol distributed (but non-blockchain) architecture (1) gives it some unique features that could address many of the shortcomings of traditional dark-pools (2).

1. Distributed.

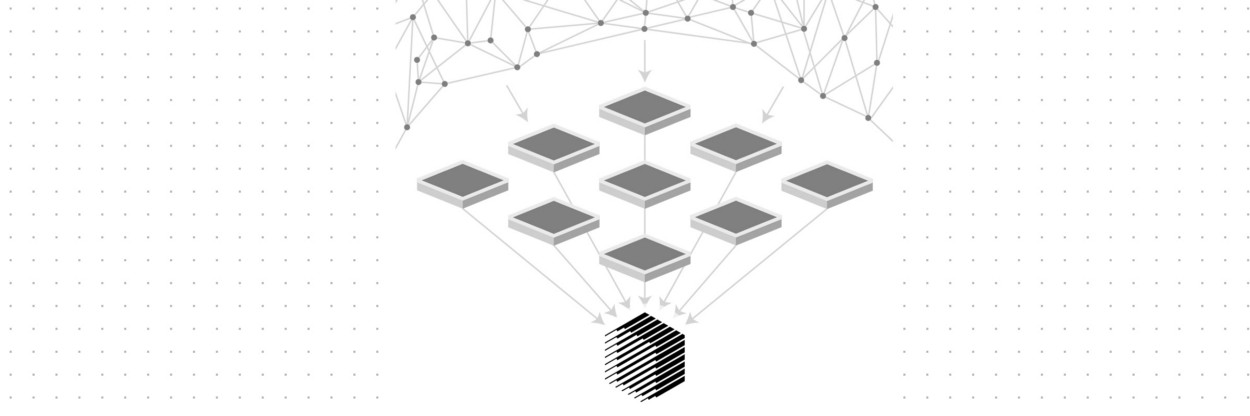

Republic Protocol consists of a base layer onto which decentralized dark pools can be built by anyone.

Republic is not a blockchain but rather a “traditional” peer to peer communication protocol (similar to BitTorrent) which uses ERC-20 tokens (secured by the Ethereum blockchain) as secure bond for the nodes on the network.

Republic nodes (aptly called dark nodes) can be set up via a client. Each node requires a 100k REN bond to be registered and, at a total supply of REN of 1 billion tokens, there can only be a total of 10,000 nodes on the network.

Together, dark nodes provide a computational base layer that powers any dark pool built on the protocol. The role of dark nodes is to privately match buy/sell orders via a cryptographic technique called Shamir’s Secret Sharing.

Although only cryptocurrencies can be transacted on the protocol, these transactions are considerably varied and can either be between assets belonging to the same chain (i.e. between Ethereum ERC-20 tokens for example) or cross-chain (i.e. ETH to BTC) via a technique called atomic swap.

So far, ERC-20 tokens (including tokenized gold), ETH and BTC have been implemented and it’s likely tokenized fiat and stable-coins (such as Gemini’s crypto-dollar) will also be integrated in the future.

2. Fairness and Availability.

Being distributed and open source, the protocol allows for the creation of dark pools where:

- the rules are transparent and fair;

- hosted APIs are directly available to traders;

- the protocol, unhindered by a blockchain architecture, can scale to a large number of transactions;

- the network is secured by a decentralized, un-hackeable network of nodes;

- crypto-currencies can be privately traded in large amounts without exposing sellers to slippage typical to centralized crypto exchanges.

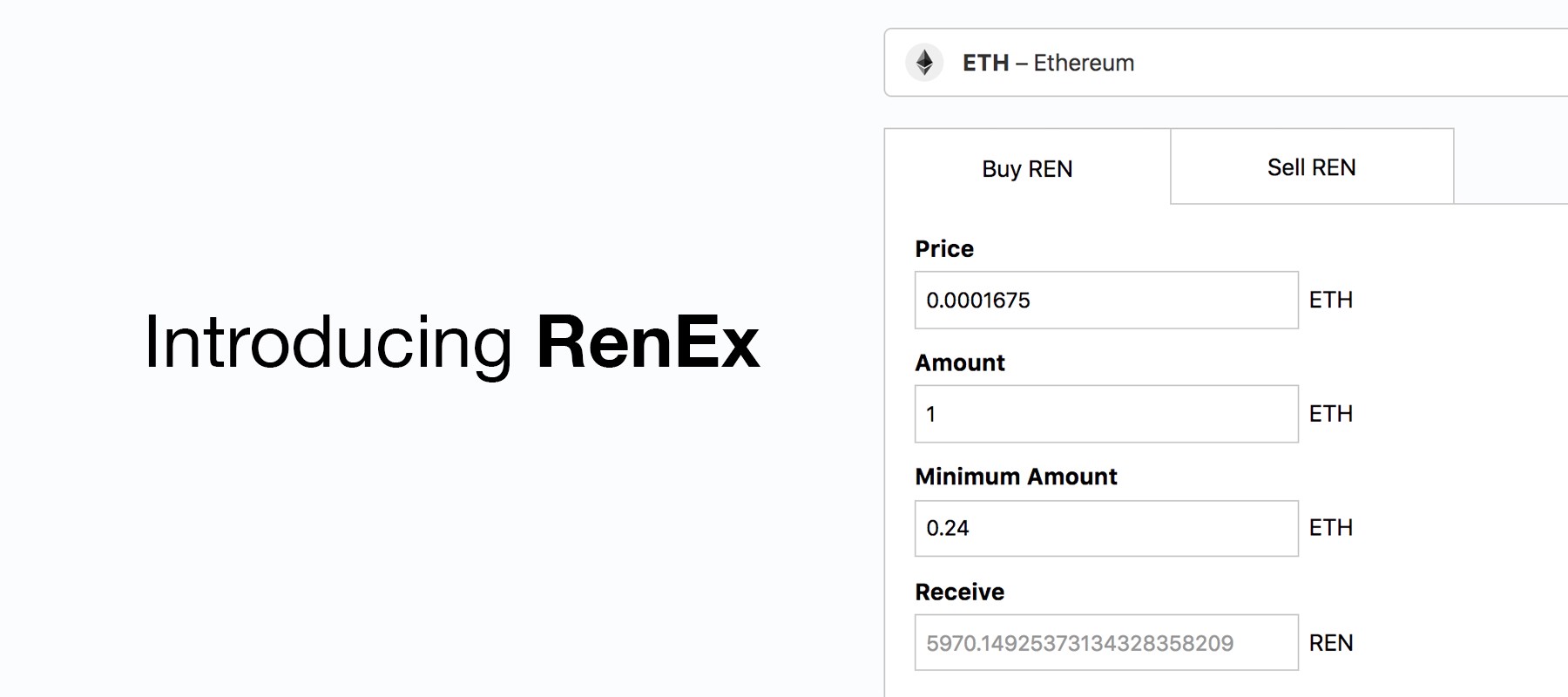

The first such dark pool, RenEx has already been built by the core dev. team and is set to launch in the coming weeks.

What’s more, the team has already secured a partnership with USA-based Wyre to ensure RenEx needs regarding liquidity and KYC/AML compliance.

“Wyre specializes in infrastructure to bridge the gap between traditional banking and digital assets. Pairing this expertise with RenEx will serve as an integral tool in Wyre’s OTC services, which to date have traded $3.5 billion in digital assets in-house and more than $750 million in bank-to-bank commercial FX payments. Working together, Republic Protocol and Wyre will help usher in a new era in dark pool trading, merging traditional financial infrastructure with the world of decentralized finance.”

from Republic Protocol Partners with Wyre.

Investment Thesis.

The investment proposition here consist in acquiring REN tokens that power the base layer of the protocol.

REN tokens are ERC-20 tokens spawned from an Ethereum smart contract. These tokens currently have two main use cases:

- traders must stake some amount of REN to transact in dark pools, this prevent spamming attack from malicious actors;

- staking 100k tokens allows anyone to become a dark node on the protocol’s layer 1 which powers the entirety of the ecosystem.

As the Republic network grows, it is to be expected that the demand for REN to stake as trader bond could put some upward pressure on the price but this requirement could also end up being eliminated as the technology matures and alternative ways to prevent spamming are discovered .

Provided they keep up with the network requirement regarding speed an bandwidth (which are expected to grow as the network develops) Dark Node operators however will always be rewarded a fraction of the total amount of every trade they discover over the entirety of the network including all the dark pools built on top of the protocol.

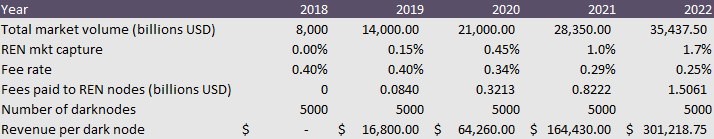

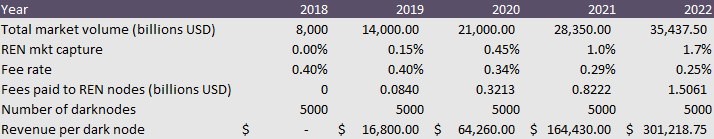

Considering the scope of the work done by dark nodes, it’s been (very optimistically) estimated that a single node could earn as much as $300k USD in a single year by 2022 (bull case scenario):

from Republic Protocol: Analysis and Valuation by James Todaro, Joseph Todaro and John Todaro

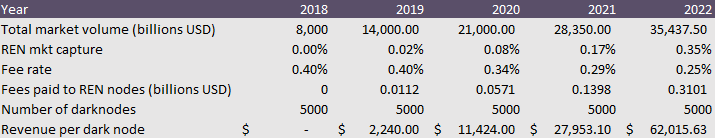

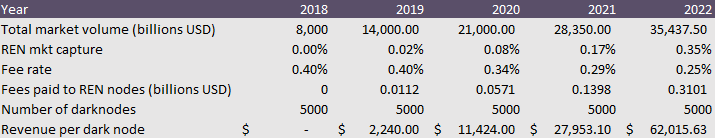

Or around $60k USD / year (base case scenario):

from Republic Protocol: Analysis and Valuation by James Todaro, Joseph Todaro and John Todaro

Unfortunately, these projections were partly incorrect:

- the maximum number of dark nodes has been set at 10k (1B total supply / 100k = maximum number of dark nodes) though the actual number of nodes could find equilibrium way short of 10k, provided REN tokens retain a utility beside being used as bonds.

- the fee paid to a dark node after matching a transaction on RenEx will initially be set at 0.32%: (0.2% maker fee + 0.2% taker fee = 0.4% > 80% of 0.4% goes to the nodes and 20% to the liquidity incentive program = 0.32%).

Now, ROI projections are a delicate endeavor (variables change) and should err on the side of caution not to disappoint investors.

With that in mind, we’ll start from the 2022 ROI divided by 3 to take into account the compression of margins, the increasing hosting costs, the maximum number of nodes at 10k and the 0.32% initial fee which is likely to diminish as competition with other dark pools increases, we expect a ROI of:

- approximately $20k/year (base case) + alpha (appreciation of 100k REN bond)

- approximately $100k/year (best case) + alpha (appreciation of 100k REN bond)

For an initial investment of $3100 USD / dark node.

Disclaimer: This is not investment advice, investors should always do their own diligence.

Other Risks.

There are a great deal of risks that must be taken into account before investing in the project.

1. Competition & Liquidity.

Competition will come from both traditional crypto OTC desks (Kraken, Gemini, Coinbase) and possibly from other decentralized exchanges (DEX) project such as 0x or Airswap which could (though haven’t yet) technically evolve to offer dark pool services in the future.

As it stands, Republic benefits from a considerable technological head start over DEXs in the sense that their first dark pool is about to go live. Besides, the project’s non-blockchain architecture allow for scaling to a large number of transactions whereas DEXs still have to find ways around the limitations of slow blockchain databases.

However, Republic’s advantage is much less evident against OTC desks run by established crypto exchanges (like Kraken’s) which dispose of a much larger network, reputation and access to liquidity than RenEx.

Ultimately, the project could fail if:

- developers show no interest in building dark pools on the protocol.

- other exchanges offer more competitive trading fees and liquidity.

2. Robustness.

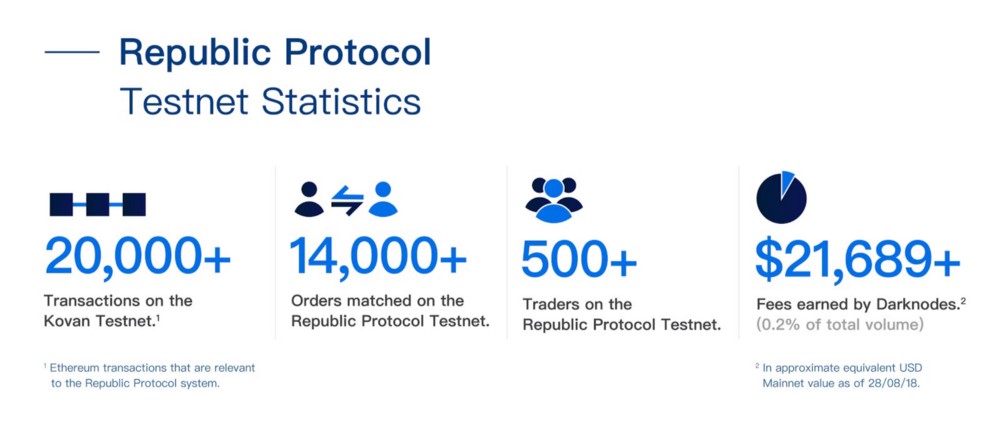

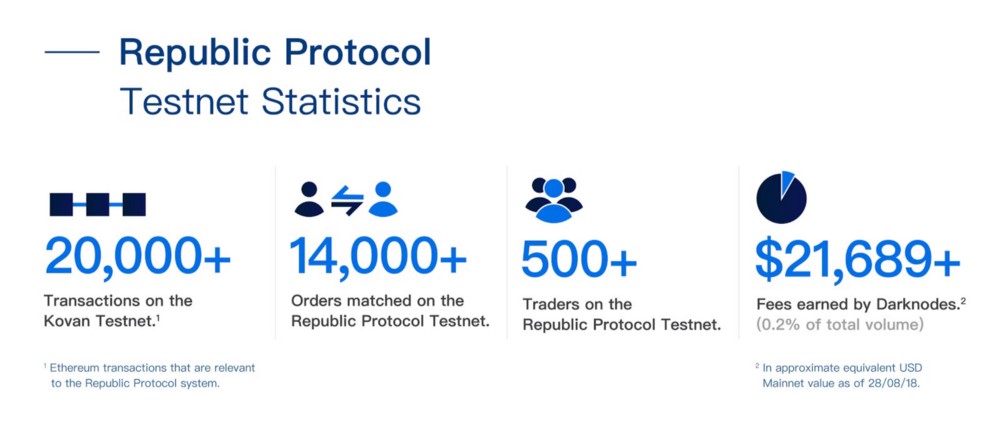

Even though the technology has shown great promises on the Ethereum testnet it is still unproven in an adversarial environment and it might be quite some time before financial service providers become comfortable trusting the network (or obtain legal clearance) with millions in crypto-currencies.

As always, the first users of this technology are expected to be smaller, entrepreneurial financial players who will likely use the protocol for small transactions first before scaling up.

Ultimately, the project could fail if:

- it proves fragile and buggy in an adversarial environment, leading to loses for users of the protocol.

However, if the technology developed by Republic shows resilience in the wild, the project could rapidly expand its pool of liquidity and even companies like Coinbase or Bitfinex (which have a strong decentralized vision ) could possibly harness the technology to power their own ecosystem.

Conclusion.

Republic Protocol offer a pertinent use case for a hybrid technology incorporating an ERC-20 token with a traditional distributed system.

Not encumbered by a blockchain architecture and developed by a dedicated team, the technology has the potential to scale fast and to bring a much needed dark pool infrastructure to the blockchain ecosystem.

However, the project’s ultimate success will depend on its ability to be secure, to attract developers and to offer a competitive trading and liquidity ecosystem to its users.

Invest at your own risks.

Disclosure: FØxSociety is long REN

Resources:

FØx (@tradealert) and @deanliu

If you liked this article, make sure to show some love by up-voting or following yours truly. You can also follow FØx on Twitter at [F0xSociety](https://twitter.com/F0xSociety) and join our [Discord Community](https://discord.gg/KrPEday) for daily live updates Monday to Friday.

Buy Digital Assets: Coinbase

Buy Digital Assets: Coinbase

Trade on Decentralized Exchanges: Radar Relay / Kyber Network

Trade on Decentralized Exchanges: Radar Relay / Kyber Network

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

May the FØx be with you.

by FØx —

This page is synchronized from the post: ‘Republic Protocol (REN) Analysis and Valuation.’

![[米其林台北指南] 牛肉麵・劉山東](https://cdn.steemitimages.com/DQmfYCyP7VqRKaQ8faXSWFeCDGFxmCivUPeW2c6Et9J6CDA/DSC_6446.JPG)

Buy Digital Assets:

Buy Digital Assets:  Trade on Decentralized Exchanges:

Trade on Decentralized Exchanges:  Keep your Crypto Safe in a Hardware Wallet:

Keep your Crypto Safe in a Hardware Wallet: