Hi traders, Dan (@tradealert) and Dean (@deanliu) are back for our weekly feature and today we’d like to show you how to trade on Radar Relay.

Radar Relay.

A while back we posted a review of the 0x Protocol in which we mentioned a few decentralized exchanges (DEX) among them Radar Relay which we’d like to talk about in more details today. We’ll start with explaining the benefits of trading on this exchange (I), then we’ll show you how to trade tokens (II) and finally how to hedge your position in a bearish market (III).

I-Benefits of trading on Radar RElay.

Radar Relay (RR) is an 0x-based DEX (D0x) which allows you to trade ERC-20 tokens and Ether directly from your LEDGER or MetaMask wallet;

Because your crypto never leaves your wallet, you are always protected against counter-party risks (hacks, phishing,etc);

You can trade on RR for no fees until the 1.0 version goes live, the fees will then be denominated in ZRX tokens;

You can broadcast orders through social medias using the carrier feature:

https://www.youtube.com/watch?v=Q41HM5U483g

II-Trading Ether and ERC-20 Tokens from a LEDGER.

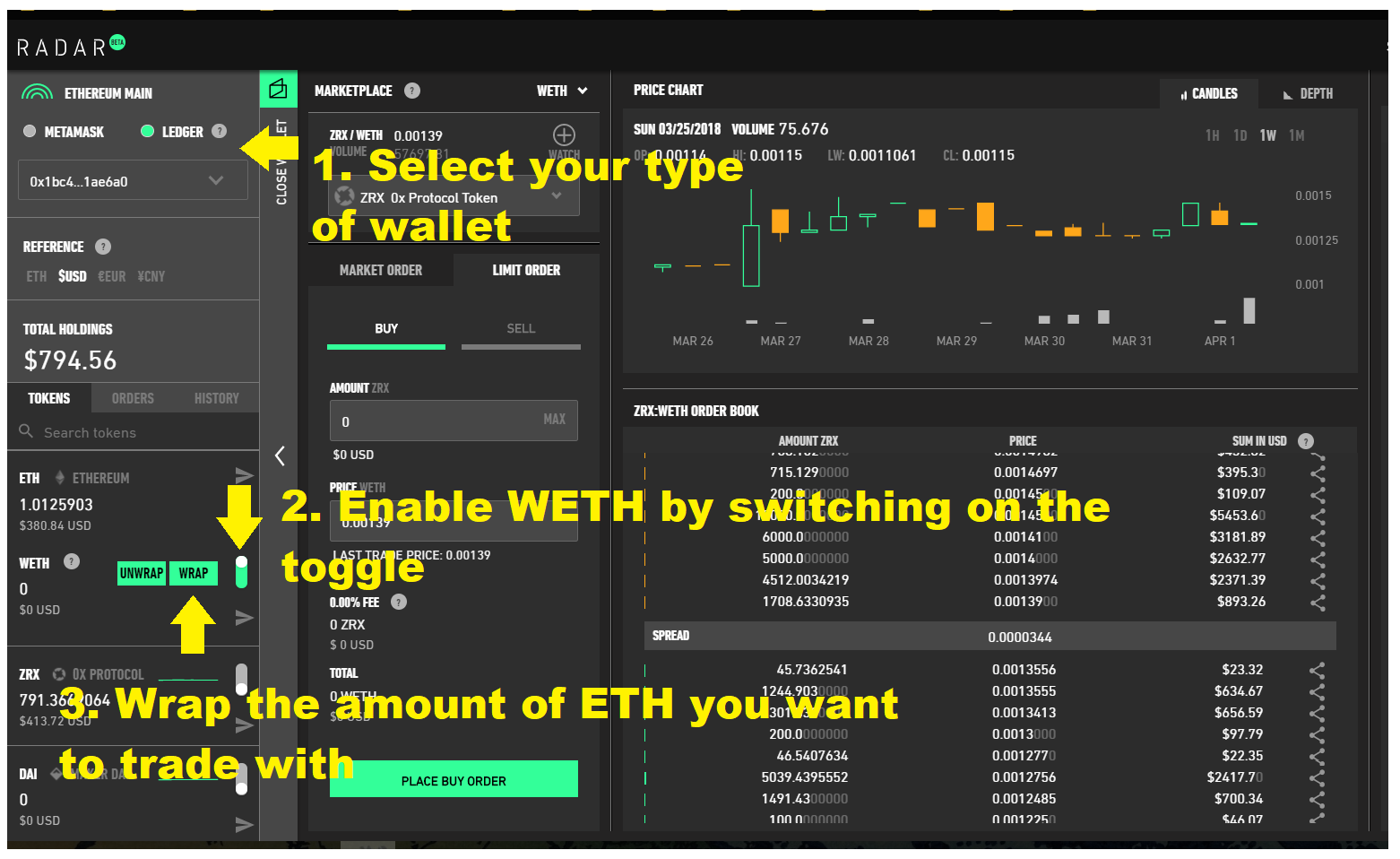

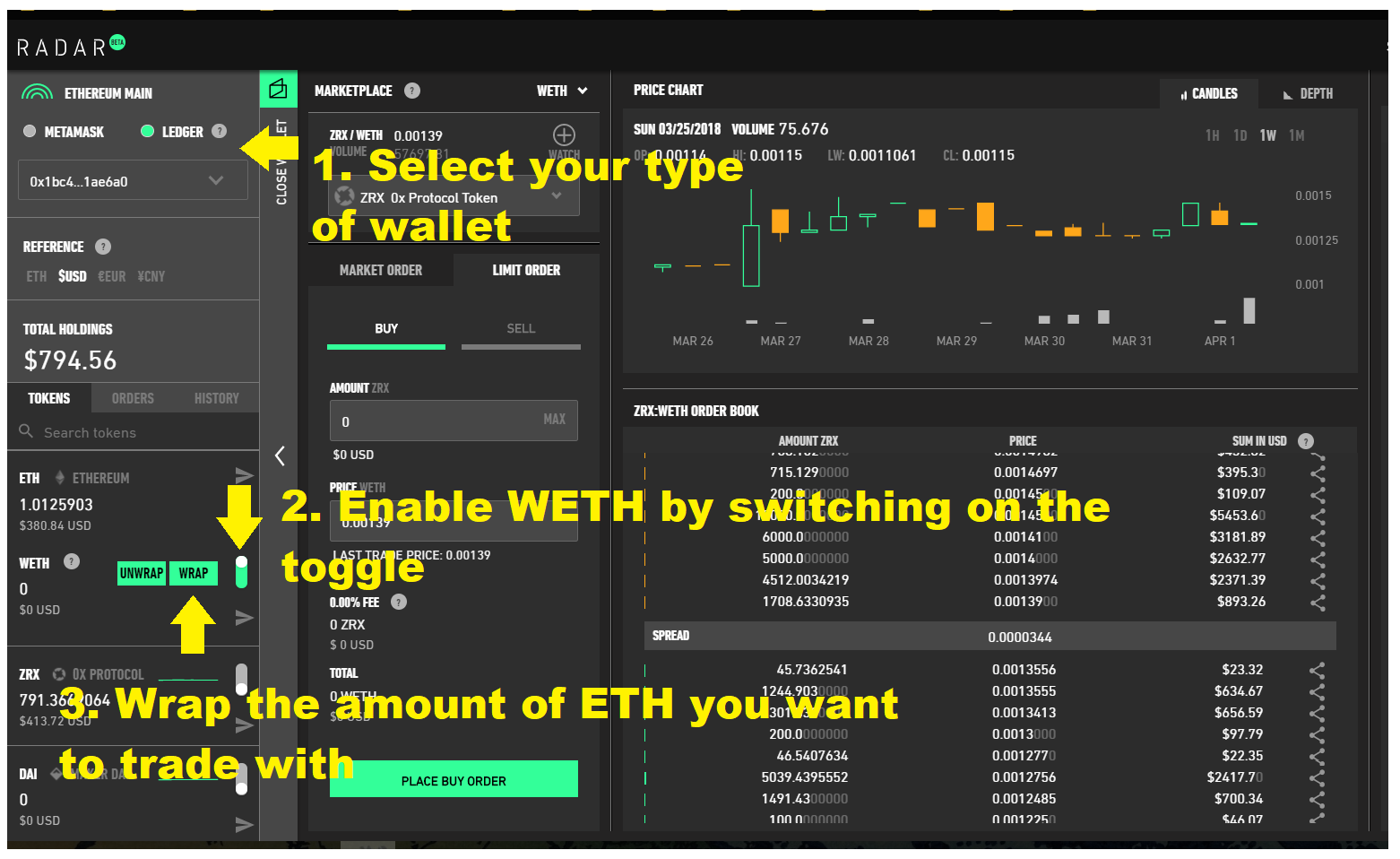

- Once in the App, follow these steps:

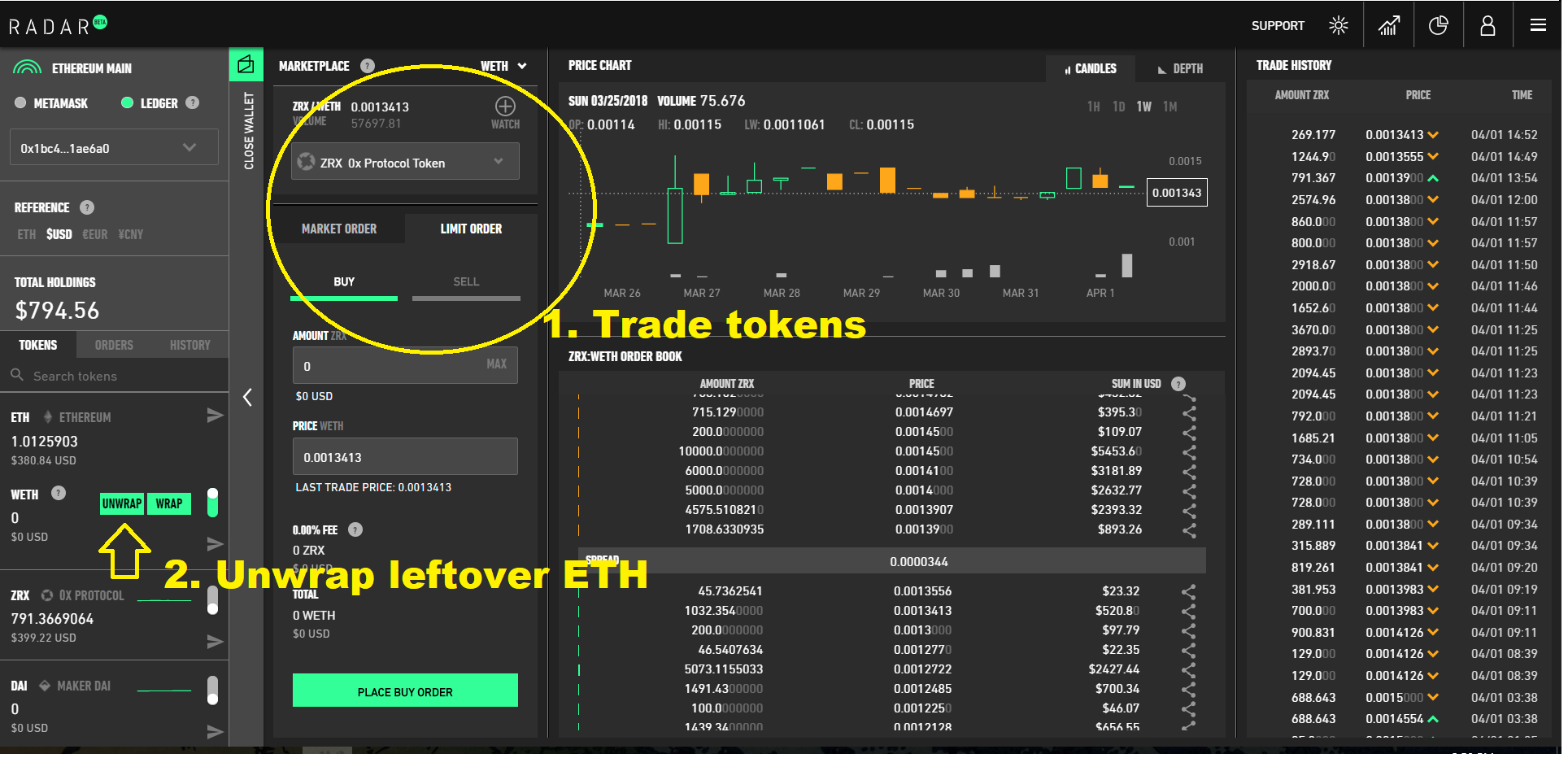

RR first need to convert (wrap) the ETH you want to trade with into WETH (WrappedETH), both wrapping ETH (3.) and enabling trading with WETH (2.) will cost you a very small transaction fee (around 2 Gwei) which you need to confirm manually on your Ledger.

- Now you can use your WETH to trade tokens as you would in a normal exchange:

- Close your trade by unwrapping leftover WETH… and that’s it, you can close the app, your new tokens are awaiting in your LEDGER.

As you can see all these operations are conducted directly from your secure hardware wallet without exposing your ETH to counterparty risk, user experience is very smooth and is only going to get better as the 0x team has announced the near release of a trading widget which will abstract away the need to wrap ETH.

III- Hedging into DAI.

DAI is a stable coin which trades on Radar Relay. Just like Tether, DAI is transferable, pegged to the dollar and can be redeemed for USD on some exchanges.

Unlike Tether though, DAI tokens are backed by Ethereum collaterals (and soon gold) and their supply is transparently managed and auditable on the blockchain which makes it a much safer hedge than Tether in our opinion.

If you’d like to know more about how DAI works under the hood, we recommend you watch this fantastic interview with Rune Christensen, the founder of the Dai project.

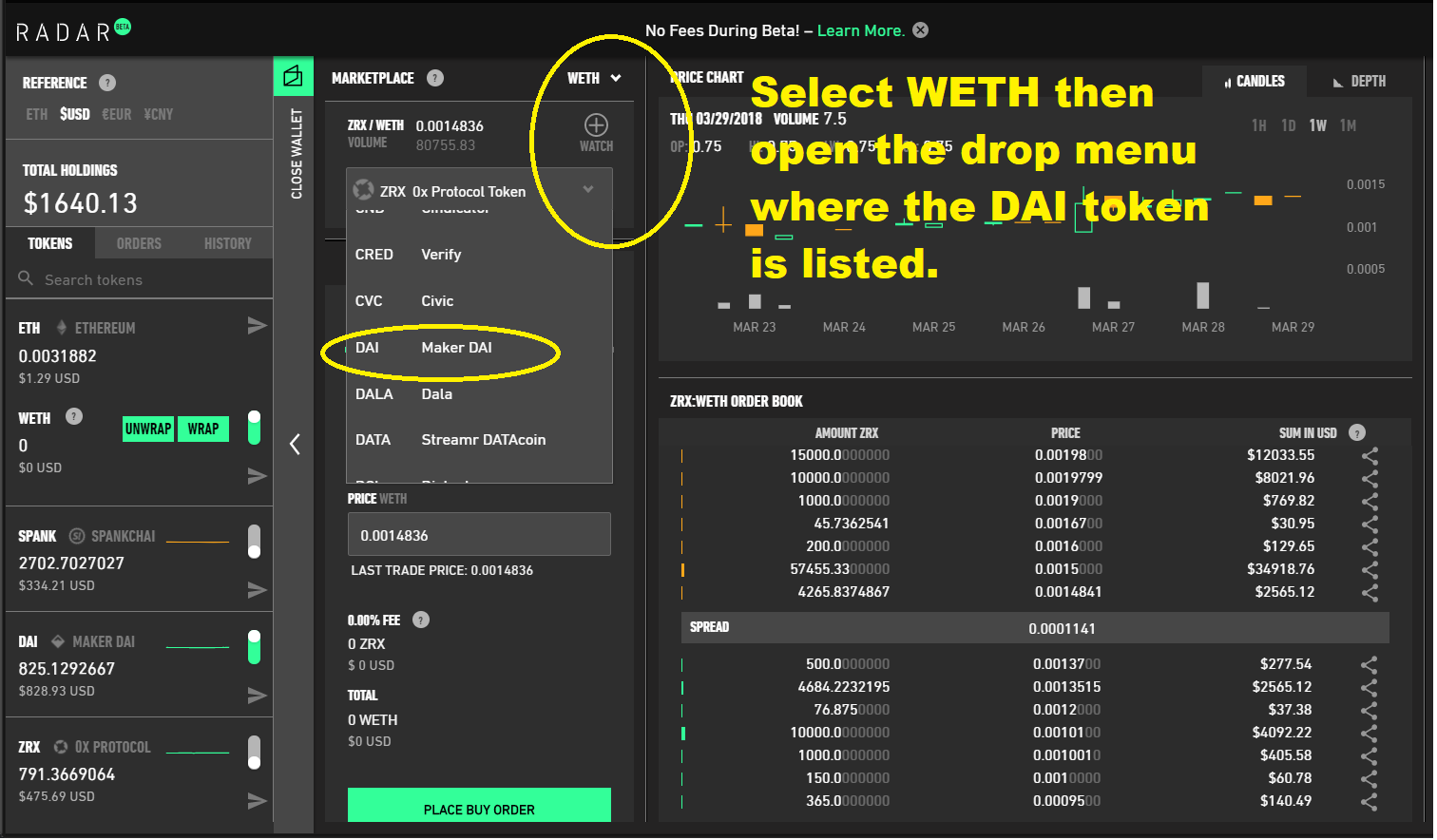

- DAI tokens can be purchased on RR for WETH as you would for any other token:

For example, hedging your ETH from your wallet would look something like this:

ETH>(wrap)>WETH>(trade)>DAI>(trade)>WETH>(unwrap)>ETH

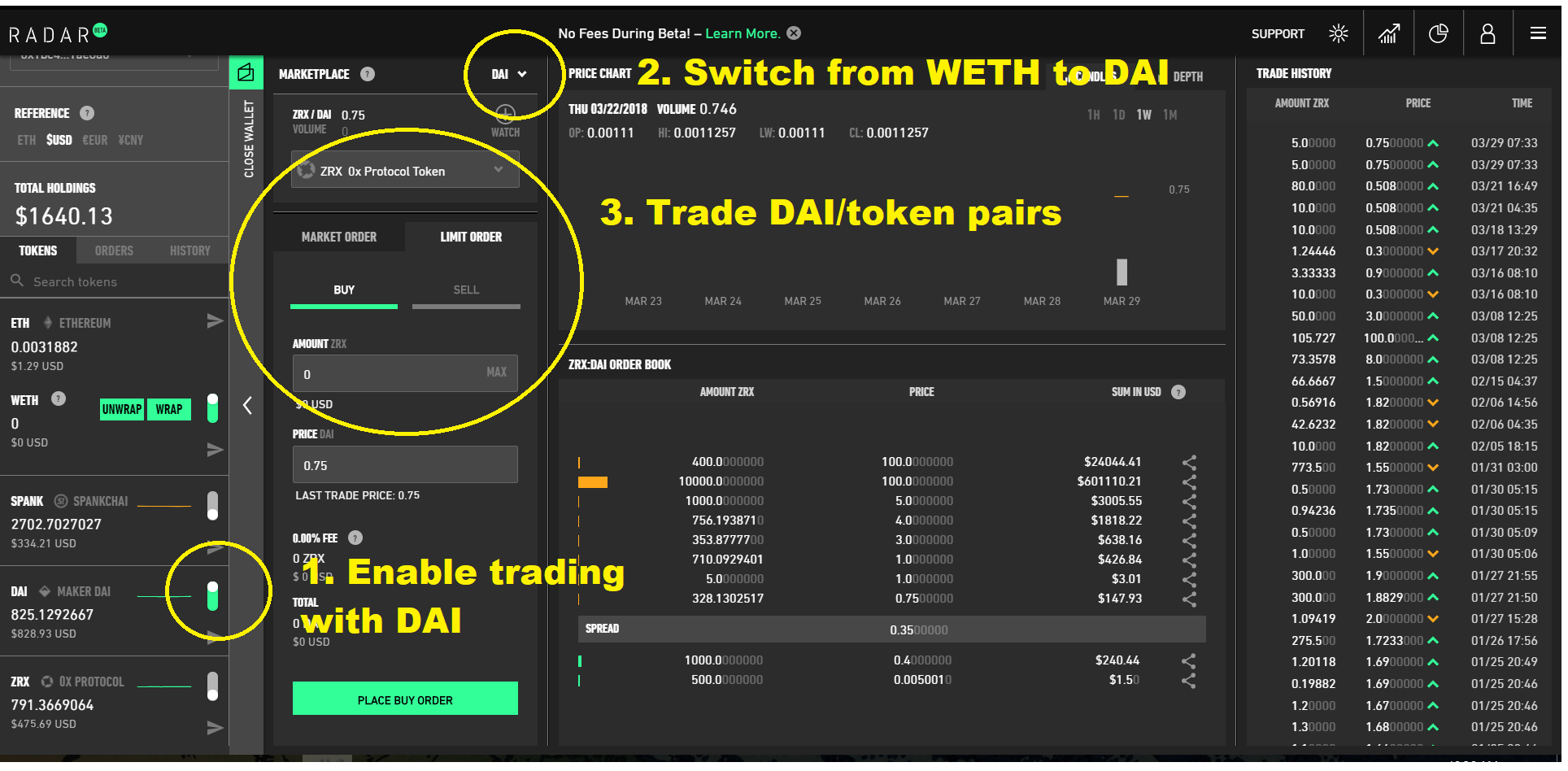

- DAI can also be traded directly for other ERC-20 tokens;

- A word of caution though, liquidity with DAI/ parings (that includes WETH) is still very thin so it’s recommended you check the spread carefully before you buy so you don’t lose money on slippage.

And that’s it for today guys, as you can see trading on RR is a breeze, the exchange truly is a wonderful piece of engineering which will give you a taste of the power of 0x-built exchanges and a glimpse into the future of what decentralized exchanges on the Ethereum network can become.

Cheers.

_If you liked this post please consider supporting Dan’s blog @tradealert and if you’re interested in learning more about cryptocurrencies, come join our [awesome community on Discord](https://discord.gg/4VGVHrs). Don’t be shy, it’s free!!_

Also, make sure to go check out Dan’s latest review this time on SpankChain and his interview with Ernie from Trader of Futures.

Dan and Dean.

Tip Jar:

?? LTC: LaMv8hWUj88ik2LBJ2ArLoe1WkfTG4M1Eq

?? ETH: 0x942a1F730f6ED432e663869d61097E73D48037d2

This page is synchronized from the post: ‘Radar Relay: Trustless Token Trading on Ethereum.’