這幾個月來常常看到有人談比特股就會問問關於UIA是怎麼回事(因為自己沒空研究想搭搭便車),但一直以來都還是停留在粗淺認識上。今天下午好好地找找看看後,雖然稍微多懂了一些,但離自己能真的去發行UIA,恐怕還有段距離。實際操作上是很簡單,真的是點一點輸入一些參數就行,但這些選項背後的意義沒搞清楚前,我還不想胡亂嘗試… 把bitshares官網的兩個相關網頁翻譯了一下,作為今日工作的成果。歡迎各位對於UIA有興趣的朋友們可以加入行列一起來把這東西搞清楚一點… Bitshares系統真的是博大精深哪!容易上手,但要懂要學的事情真的還好多哪~

This post is a Chinese translation of two webpages (1,2) that are related to UIAs, which I am trying to study further and hopefully I can manage to try to issue some UIAs of my own soon.

ASSETS/TOKENS

比特股2.0網路有多種資產/代幣/貨幣。所有資產從技術角度來看都是一樣的,其特點都相差不大,主要特點是都可以在幾秒鐘之內相互交易或轉移。它們之間的差別主要是從其經濟特性來決定的。

The BitShares 2.0 network consist of several assets, tokens or currencies. All assets are equal from a technological point of view and come with more or less the same features, namely, they can be traded against each other and can be transferred within seconds. The differences between them are of economical nature.

比特股網路包括以下六種資產:

可由個人用戶根據各種應用場景所需而創造的自由交易代幣,例如股票、哩程、活動票證或是信用點數等。

Freely traded tokens created by individuals used for a variety of use-cases, such as stock, miles, event tickets or reputation points.

這些智能代幣(SmartCoins)用來盯緊特定之基本資產的價值,例如黃金、美元等。智能代幣創造者必須與比特股生態系統締約並將足夠之比特股(至少175%)放入所謂的擔保貸款來做為抵押品。

These SmartCoins track the value of an underlaying asset, such as Gold, or U.S. Dollar. Smartcoins can be created by anyone contracting with the BitShares ecosystem and putting sufficient BTS (at least 175%) into the so called collateralized loans as collateral.

這種資產通常被稱為借條(IOU),其可行使一個從特定中心實體提領等量背書資產的權利(手續費除外)。通常這是由銀行、交易所或是其他金融機構所發行,來代表存款的憑據。

This kind of asset is commonly known as I owe you (IOU). It represents the right to withdraw the same amount (minus fees) of a backing asset from a central entity. Often they are issued by a bank, an exchange or an other financial institute to represent deposit receipts.

此一資產可適當混合UIA與MPA特性,允許第三方創造適合自己的市場錨定資產(MPA)。

A flexible mixture between UIA and MPA that allows 3rd parties to create their own customized MPAs.

擁有此類資產將可以按比例獲得由特定經濟活動產生之交易費用,該活動是獨立於比特股網路來運作的。

An FBA is a token that pays you a fraction of the transaction fees generated by a particular feature that has been funded independent of BitShares.

- 預測市場資產

Prediction Market Asset

此一資產與MPA類似,只是其錨定值介於零與一之間。在預測事件結束後,餵價(price feed)可以用來決定採行哪一個選項,然後參與者再按此價格結清平倉(settle)。

A prediction market is similar to a MPA, that trades between 0 and 1, only. After an event, a price feed can be used to determine which option to take and participants can settle at this price.

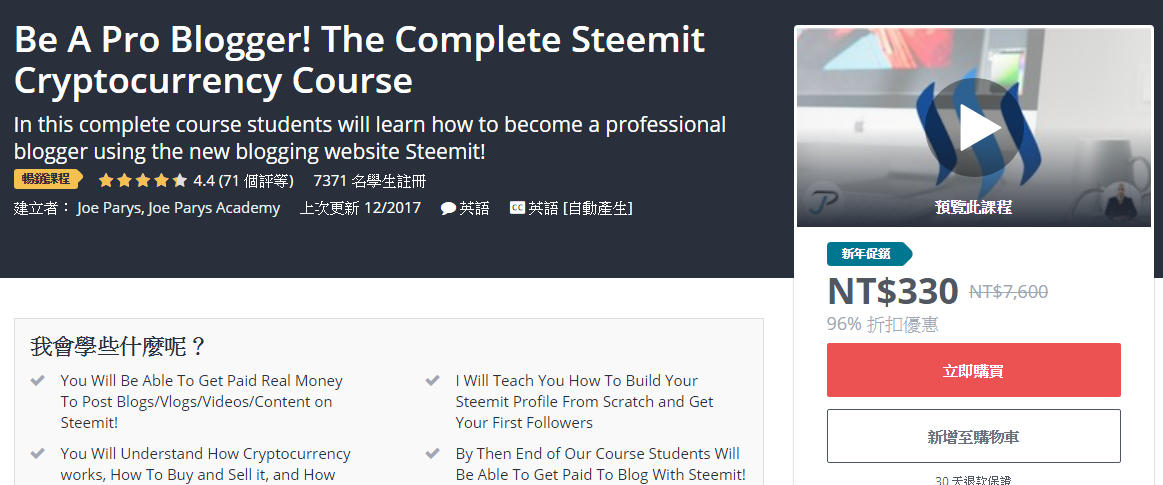

比特股允許個人與公司創造發行任何他們所能想像的代幣,這些UIA其潛在可運用的場景無可限量。從最簡單的來說,UIA可以用來作為一個活動票證的解決方案,可以把票證儲存於參加者的手機裡,來作為例如音樂會的入場方式。或是UIA可以用來進行群眾募資、所有權管理,甚至作為公司股票發行的方式。

BitShares allows individuals and companies to create and issue their own tokens for anything they can imagine. The potential use cases for so called user-issued assets (UIA) are innumerable. On the one hand, UIAs can be used as simple event tickets deposited on the customers mobile phone to pass the entrance of a concert. On the other hand, they can be used for crowd funding, ownership tracking or even to sell equity of a company in form of stock.

要發行UIA其實很簡單,只需要在系統裡為你的代幣選擇一些參數,例如供給量、精度、代號、簡介,之後不用幾秒鐘,你的幣就誕生了。此後,你就可以把你發行的幣給任何人,或是賣出,或是馬上就可以與其他比特股既有的其他資產/代幣相互交易。

All you need to do is click in order to create a new UIA is a few mouse clicks, define your preferred parameters for your coin, such as supply, precision, symbol, description and see your coin’s birth after only a few seconds. From that point on, you can issue some of your coins to whomever you want, sell them and see them instantly traded against any other existing coin on BitShares.

作為代幣發行者,你對於你的幣享有某些特權,例如,你可以決定其市場內的交易配對,管理誰能或不能擁有你的代幣的白名單或黑名單。不過,當然你也可以在信任與名聲的考量下,主動選擇放棄這些特權。

Unless you want some restriction. As the issuer, you have certain privileges over your coin, for instance, you can allow trading only in certain market pairs and define who actually is allowed to hold your coin by using white- and blacklists. Of course, an issuer can opt-out of his privileges indefinitely for the sake of trust and reputation.

雖然是在區塊鏈上發行代幣,但是你無須處理任何相關技術細節,諸如分散式共識機制、區塊鏈之開發或整合等,你甚至完全不需要運作任何挖礦設備或伺服器等。

As the owner of that coin, you don’t need to take care of all the technical details of blockchain technology, such as distributed consensus algorithms, blockchain development or integration. You don’t even need to run any mining equipment or servers, at all.

那麼,發行這種資產有什麼可能疑慮嗎?

So what’s the drawback?

在這樣場景下,發行新代幣主要的疑慮來自於中心化的發行者。某種程度上來說,這種疑慮可以透過採用階層式多重簽名帳號的管理方式來降低單一個人發行的風險,這種方式透過特定群體的共識來授權代幣發行條件的變更。

There is a drawback in this scenario, namely, a centralized issuance of new tokens. To some extend, this could be managed by a hierarchical multi-signature issuer account that prevents any single entity from issuing new coins but instead requires a consensus among an arbitrary set of people to agree on any changes to the coin.

不同國家對於不同性質代幣發行的相關法律規範差異甚大,因此,比特股也提供許多便利性的工具以便於代幣發行者能夠符合相關法規,當然前提是當局允許這類資產的發行。

Obviously, the regulations that apply to each kind of token vary widely and are often different in every jurisdiction. Hence, BitShares comes with tools that allow issuers to remain compliant with all applicable regulations when issuing assets assuming regulators allow such assets in the first place.

使用場景舉例

- 紅利點數

- 粉絲點數

- 飛航里程

- 活動票證

- 數位財產

- 群眾募資

- 公司股份

USE CASES

Reward Points

Fan Credits

Flight Miles

Event Tickets

Digital Property

Crowd-Funding

Company Shares

https://steemitimages.com/0x0/https://steemitimages.com/DQmYYpgMur6QJQQaNnQZqgWCYTmzeeXJSus4C4sb2Cy5iNd/%E8%9E%A2%E5%B9%95%E5%BF%AB%E7%85%A7%202018-01-01%20%E4%B8%8A%E5%8D%8812.08.37.png

This page is synchronized from the post: ‘翻譯分享:比特股系統內之用戶發行資產(UIA)’

![[ Steem十講之第六講 ] 人生相對論 Relativity of Life](https://steemitimages.com/DQmVic5B8HnApxjbBsiMXzX7qQS1GpithdiUjMCK4xrMLTV/albert-einstein-219675_640.jpg)