In my less-than-a-year activity in crypto, this is the biggest bear market I’ve ever seen so far. And this is the best time too for examining each of my holdings when they are literally stuck for trading at such a terrible price.

I scan through my long-term holding coins to identify which of them are able to self-generating income.

Coins that is not self-generating

Bitcoin: Not providing any value if not using for payment. Maybe can be a source to bring some bonus from bitcoin hardfork, like Bitcoin cash, Bitcoin Gold and etc.

Ethereum: Some new ERC20 tokens will airdrop to ETH holders. Except that, ETH is not generating income.

Cardano: ADA is mainly used for creating new smart contract like ETH and the platform is not ready yet. Not generating income.

Litecoin, Stratis, Bitcoin Cash, Golem, Siacoin, IOTA is not generating any income by just holding it.

Self-generating coins

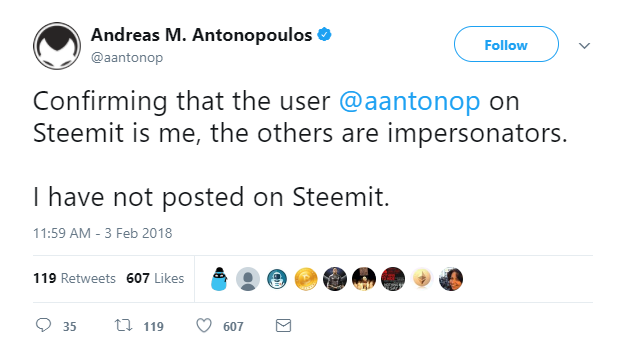

Steem: Nuff said. Even you are not participating in the Steem blockchain by authoring and curating, simply power up Steem to Steem Power is enough to earn the dividend from inflation every day. You could even sell your SP by delegate to others via Minnowbooster for higher income as well. Steem is definitely a self-multiplying machine.

Neo: Holding neo will generate free GAS everyday and the price of GAS tends to follow NEO’s. Not a bad way to treat it as some passive income.

Byteball: The nature of this coin is not self-generating, but the strategy running the devs is unique. They want to airdrop almost all the Byteball supply and so far 65% has been distributed. Holding Byteball can earn more of it by airdroping.

These 3 coins are my holdings that are self-generating, what is yours?

在熊市中,很多持有的币都狠狠的被套着了。这让我不禁反思有哪些币在这样的环境中依然能够自我增值。

比特币作为支付用途,如果不用来支付就等于没用 。但是持有比特币还是有些增值的旁门左道,就是那些硬分叉币比如BCC 和 BTG 。

ETH 也不会自我增值,除了某些新的 ERC20 代币有时会空降下来。

Litecoin, Stratis, Bitcoin Cash, Golem, Siacoin, IOTA 全部都不会自我增值。

接下来就说说那些会生蛋的母鸡币了

Steem 当然当之无愧的是以币生币的最佳母鸡。就算完全不参与写作和 Curation,Steem Power 还是能让你每天收到系统通膨带来的分红,更别说通过 Minnowbooster 卖 SP 能赚更多了。

持有 NEO 也会根据一定的比率分发 GAS,而 GAS 的价格根据历史而言也是和 NEO 一起浮动的,所以也不失为一个被动收入的方法。

Byteball 虽然设计上不会自我增值,但是开发团队会把几乎接近总量的币靠空降的方式派发给持有者。目前总共才派发出 65% ,也是个不错的选择。

你有什么会下蛋的好币?

This page is synchronized from the post: ‘Coins that lay eggs like a chicken 会下蛋的币’