Many people think that rate hike will make dollar stronger and hence not good for the gold price. That’s what the mass media keeps telling you. However, the reality is just the opposite, so don’t be fooled by them.

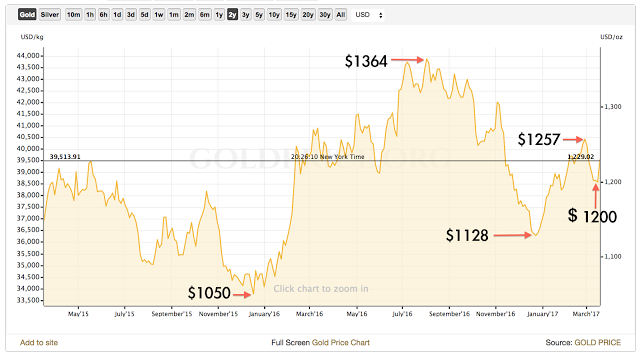

Every time when the FED increased interest rate (when the gold price was $1050 [12/2015], $1128 [12/2016], $1200[3/2017]), the gold price dropped BEFORE the rate hike but rose significantly AFTER the rate hike.

So BUY GOLD in June after FOMC

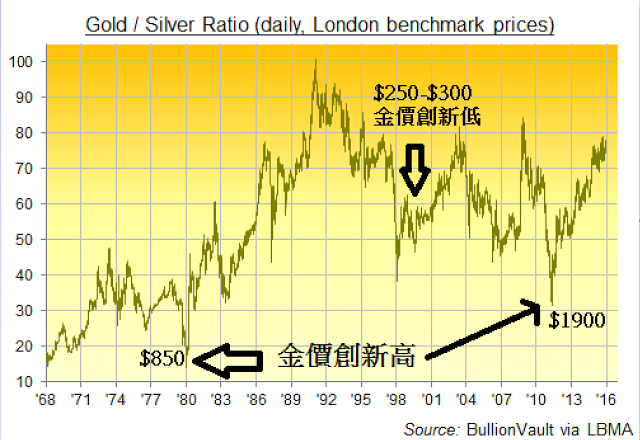

Another factor we consider when to buy gold is gold/silver ratio, when it’s near 80~100, it is definitely a great time to buy gold (or silver) and when the ratio reaches the 20~35 range, its probably the time to sell gold when they make a all-time high, which occurred in the late 1980s and 2011.

This page is synchronized from the post: ‘The effect of rate hike and how to predict gold price by gold silver ratio’