I did a reflection on my trading strategy in altcoin trading which could totally hinder the trading activity when the overall market is bearish. Yes, which is the market we currently at, a big bear crypto market.

I was constantly searching for a better, reliable strategy on trading. As I do not wish to put too much of time and effort on following every single coin’s movement in the rapid market, putting my trust to trading channel who can do the job much better than me was a great idea. While their trading signals could be useful base on accurate news, the fact is no one could ever predict how the market is going to behave.

Here I present you the next strategy I’m going to apply next, Portfolio Rebalancing

I knew this technique for quite a while the first day I trading in stock market, most of the investment geeks out there would know too. But I have never take a serious look at it, I was aiming to find some projects that could offer 100X return which of course never happened to me yet.

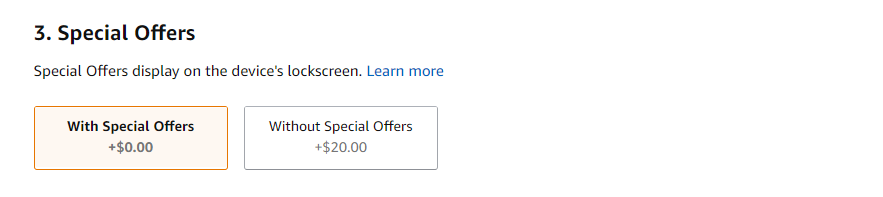

For those who has no idea about portfolio rebalancing, this is how it works:

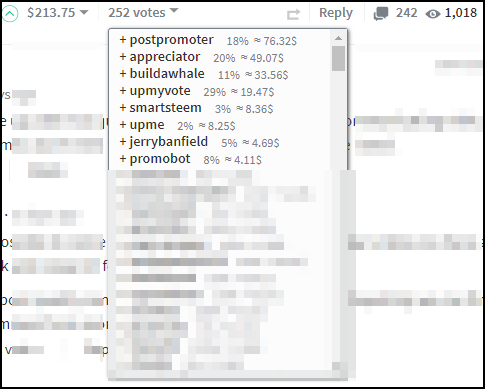

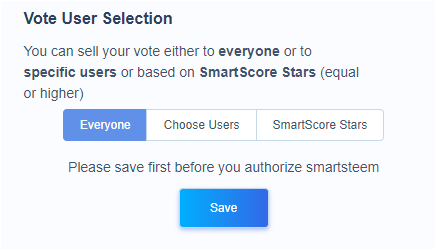

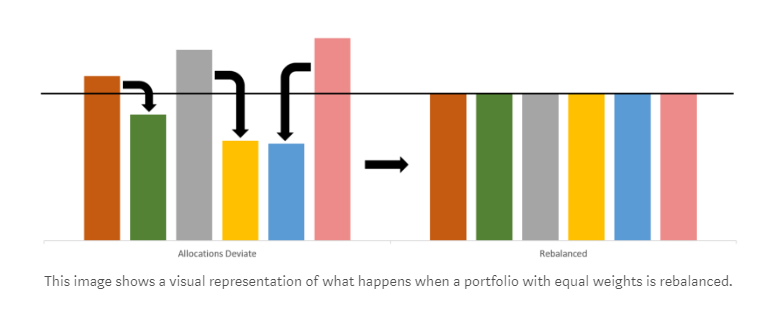

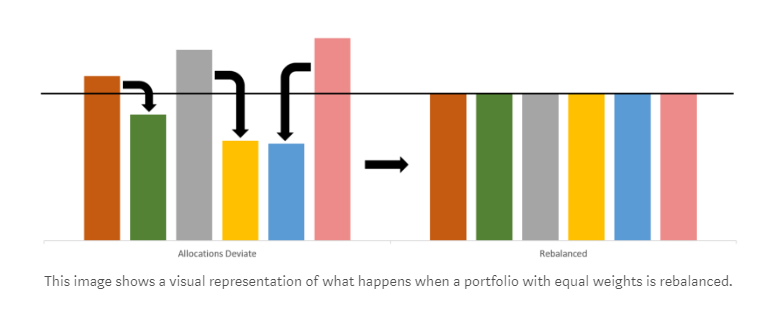

Investor setup a portfolio with several assets which he would set certain ratio each asset should contain in the portfolio, total ratio adds up to 100%. Let’s say Bob assign 6 assets to his portfolio with 16.67% each. He would take a look at it at the end of every month, and those assets would have performed differently. Like the diagram below.

Image

sourceSome performed well that went up to 20% and some dropped to 10% in the ratio. What Bob needs to do is just rebalance the whole portfolio by sell way the excessive portion of the well-performed asset and fill in the underperformed one. The portfolio is now rebalanced, until they are out of ratio again.I was actually inspired by this

article. It even demonstrates how useful this technique is by the following real-life calculation:

>In order to demonstrate the potential advantage over holding coins, we performed a simulation with real market data over a 1-year period. This period started on December 1st 2016 and ended on December 1st 2017. With an initial investment of $5,000, we allocated an equal amount into Bitcoin, Ethereum, Ripple, Dash, and Litecoin ($1,000 in each). At the end of the one-year period, a person who had bought and held each currency would have $223,596.05. On the other hand, a person who had rebalanced over the same period, would have $353,000.87.

This means rebalancing performed 58% better over buy and hold after 1 year.You might argue that one does not simply predict the future base on history. But in this case it is really convincing to me and attractive enough to start practicing it. You can use their

Shrimpy rebalancing bot for auto rebalance execution which is now limited on Bittrex and Poloniex only, or you can build a spreadsheet profile and execute rebalancing manually. If you have some programming skill, you can even build your own bot.

## Advantages vs Disadvantages

Based on my analysis, portfolio rebalancing has it’s good and bad as well. Nothing is suitable for everyone right?

#### The good:

- Totally get rid of the biggest of trading: emotion. We all have been the victim of FOMO and FUD. By rebalancing you care no about news or TA, making everything back in designated ratio is all needed to do.

- Especially suitable for Hodler. If your belief is

Hold until they are at the Moon, this technique could make hugely improve your final return.

- No news tracking, no line drawing on the charts and listen to no BS by those experts. Now you can save tons of time and get a life.

#### The bad:

- For greater rebalancing convinience, all the involved coins need to put on exchange’s hand. And you don’t technically own whatever coins in the exchange.

- All the assets in the portfolio must be performing well in the long run. Or else you will be pouring more and more winning money into the weak coins over times.

- You are not getting 100X or 1000X return by rebalancing.

This is not a financial advice. You are at your own risk.

继上次的投资策略反思后 ,发现根据信号进行买卖不会有太好的效果。主要是尽管根据新闻的信号还算可靠,但事实是没有人可以真正预测市场将会往哪个方向走。现在这个忽如其来的币圈大熊市就是很好的例子。

接下来会尝试投資組合再平衡(Portfolio Rebalancing)。相信这个投资策略对很多投资老手来说不会新鲜。对没听过的人还是要介绍下:

根据启发我不少的这篇文章,投資組合再平衡就是设置好每个资产的比例,过一段特定的时间再把同样一套投资组合重新平衡到当初的比例。

这样做的获利原理就是将表现好的货币买了,来买进表现不好的。投資組合再平衡很无情的使投资者严格的执行了“买高卖低”这个赚钱的万年不变真理。请留意“无情”一词,这个策略完全摒弃了投资者最为危险的情绪,从而降低了犯错的几率。有频繁在市场交易过的人都受过 FUD 和 FOMO 不少大亏。

另一个大好处就是你不再需要再时时捕风抓影,在走势图上画没人看得懂的线条,更加不用去听所谓专家们的独家分析。时间到,把跑掉的组合比例调回来就好。可以使用这个软件进行自动再平衡化。

当然这也不是完全没有坏处的:

- 这不会让你一夜之间有百倍的回报,投资冷门币却有可能。

- 需要把组合里的币都放在交易所里。

- 所选定的币种必须长期下来都是有好的发展,不然等于慢慢的把赚回来的钱丢进亏钱的无底洞,所以必须选稳定的大币作为组合基调。

以上的言论不构成投资建议

This page is synchronized from the post: ‘Best trading strategy for HODLers!’